Medicare 101: Navigating with Clarity and Care - English

This educational PDF helps guide individuals through understanding Medicare with clarity and attentive support.

Helping You Navigate Medicare with Clarity and Care Medicare 101 Presentation is for education purposes

Start Planning Today Medicare & Medicaid Original Medicare Medicare Advantage (Part C) Medicare Part D Medicare Supplements Enrollment

Medicare vs. Medicaid Federal health insurance for anyone 65 or older, and individuals with certain disabilities or conditions Funded in part by federal payroll taxes that are paid while you are employed Individual health insurance Medicare Parts A and B are known as Original Medicare Medicare A joint federal and state government program that helps health care costs for individuals, families, and children with limited income and resources Medicaid programs and eligibility varies per state and follows federal guidelines for benefits Medicaid

If you have Medicare and qualify for full Medicaid coverage: Your state will pay your Medicare Part B (Medical Insurance) monthly premiums Depending on the level of Medicaid you qualify for, your state might pay for: Medicare costs like deductibles, coinsurance, and copayments Part A (Hospital Insurance) premiums, if you have to pay a premium for that coverage Medicaid may pay for other drugs and services that Medicare doesnt cover Based on resources and income, some may also qualify for Extra Help with the costs associated with a Medicare prescription drug plan Can help with monthly premiums, annual deductibles, and prescription co - payments Many qualify for the program and are unaware Social Security will need to know the value of your savings, investments, real estate (other than your home), and your income Dual Eligibility: Extra Help/LIS for Medicare Prescription Drug Costs:

Who is eligible for Medicare? US citizens and legal residents You must also meet one of the following requirements: Legal residents must live in the US for 5 consecutive years leading up to applying for Medicare People who are under 65 and qualify due to disability or other special circumstance People with ALS, ERSD, or permanent kidney failure that requires dialysis If you choose to work past 65 Medicare and your employer insurance can work together You can delay your enrollment without a penalty if your employer has more than 20 employees and your employer group plan also must be considered credible coverage If you enroll in any part of Medicare, you will no longer be able to contribute to an HSA Medicare will not cover dependents

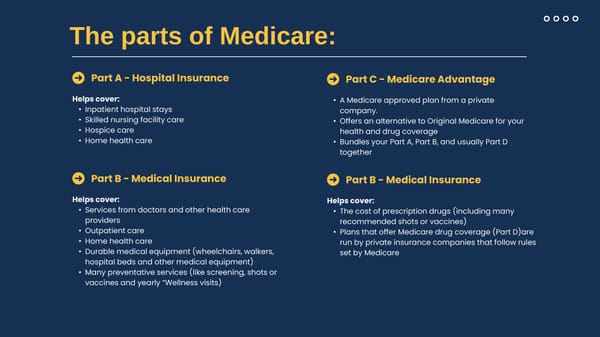

Helps cover: Inpatient hospital stays Skilled nursing facility care Hospice care Home health care The parts of Medicare: Part A - Hospital Insurance Part B - Medical Insurance Helps cover: Services from doctors and other health care providers Outpatient care Home health care Durable medical equipment (wheelchairs, walkers, hospital beds and other medical equipment) Many preventative services (like screening, shots or vaccines and yearly Wellness visits) A Medicare approved plan from a private company. Offers an alternative to Original Medicare for your health and drug coverage Bundles your Part A, Part B, and usually Part D together Part C - Medicare Advantage Part B - Medical Insurance Helps cover: The cost of prescription drugs (including many recommended shots or vaccines) Plans that offer Medicare drug coverage (Part D)are run by private insurance companies that follow rules set by Medicare

Medicare Part A pays for hospice care: $0 for covered hospice care services You may pay a copayment of up to $5 for each prescription drug and other similar pain relief and symptom control products while youre at home 5% of the Medicare - approved amount for inpatient respite care Medicare Part A pays for Skilled Nursing Home Stays: Days 1 - 20 = $0 copayment Days 21 - 100 = $209.50 copayment each day Days 101 and beyond = you pay all costs Medicare Part A pays for qualified home health care: $0 for covered home health care services 20% of the Medicare - approved amount for durable medical equipment such as wheelchairs, hospital beds, walkers, and other equipment Medicare Part A

Deductible and premium The deductible for Medicare Part B is $257. You will pay this deductible once each year before Original Medicare starts to pay Medicare Part B premium is usually $185 each month, but can sometimes be higher depending on your income You will usually pay 20% of the cost for each Medicare - covered service after you have paid your deductible The amount changes each year and you will pay the premium monthly regardless of how often you use Part B covered services Co - Insurance - Inpatient and Outpatient You will pay 20% of the Medicare - approved amount for most doctor services while you are a hospital inpatient You will usually pay 20% of the Medicare - approved amount for doctor and other health care providers services when receiving outpatient hospital care You will pay a copayment for each service you get in a hospital outpatient setting(with the exception to certain preventative services) Co - Insurance for Durable Medical Equipment (DME) You will usually pay 20% of the Medicare - approved amount for DME (hospital beds, walkers, wheelchairs etc. Medicare Part B

Includes: Part A Part B Most Plans Include: Part D and Supplemental Coverage In addition, includes: Medicare - approved plan from a private company that offers and alternative to Original Medicare for your health and drug coverage Bundle Part A, Part B, and usually Part D together In most cases you can only use doctors that are in the plans network Often have out - of - pocket costs different than Original Medicare or supplemental coverage May offer extra benefits that are not available with Original Medicare Medicare Advantage (Part C)

Includes: Part A Part B Most Plans Include: Part D and Supplemental Coverage In addition, includes: Includes Part A (Hospital Insurance) and Part B (Medical Insurance) You can add a separate Medicare drug plan for Medicare drug coverage ( Part D) Eligible to use any doctor or hospital in the US that takes Medicare You can also buy supplemental coverage that helps pay your out - of - pocket costs (like your 20% coinsurance) Original Medicare (A&B)

Part D: Prescription Drug Plans How does Medicare drug coverage work? Helps cover the cost of prescription drugs (including many recommended shots or vaccines) Plans that offer Medicare drug coverage are run by private insurance companies that follow rules set by Medicare Cover specific brand name and generic drugs that are included in the drug list, known as the formulary There are 2 ways to get Medicare drug coverage: Medicare drug plans - these plans add Medicare drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Advantage Private Fee - for - Service Plans, and Medical Savings Account (MSA) Plans. You must have Part A and/or Part B to join a separate Medicare drug plan Medicare Advantage Plans or other Medicare health plans with drug coverage. You get Part A, Part B, and Medicare drug coverage through these plans. You must have Part A and B to join a Medicare Advantage Plan, and not all Medicare Advantage Plans offer drug coverage

Medicare Supplement (Medigap) Medicare Supplement or Medigap is extra insurance you can buy from a private company that helps pay a share of some of the costs for approved services with Original Medicare Medigap policies are standardized and most states name them by letters. Each is a different Plan and has different coverage levels Premiums will be different with each carrier and will increase on an annual basis

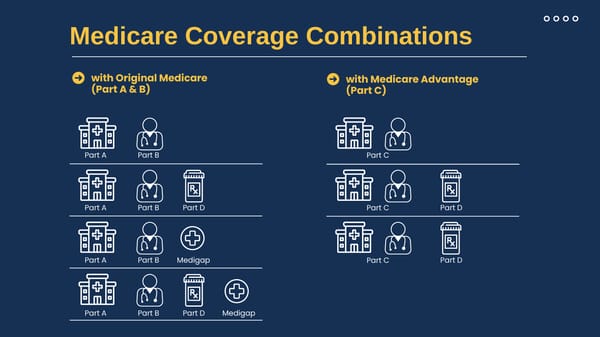

Medicare Coverage Combinations with Original Medicare (Part A & B) with Medicare Advantage (Part C) Part A Part A Part A Part A Part B Part B Part B Part B Part D Medigap Part D Medigap Part C Part C Part C Part D Part D

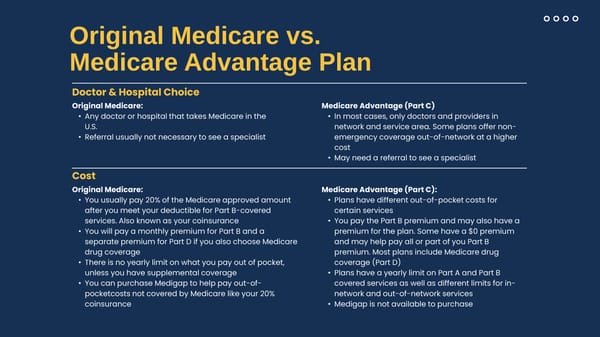

Original Medicare vs. Medicare Advantage Plan Doctor & Hospital Choice Original Medicare: Any doctor or hospital that takes Medicare in the U.S. Referral usually not necessary to see a specialist Medicare Advantage (Part C) In most cases, only doctors and providers in network and service area. Some plans offer non - emergency coverage out - of - network at a higher cost May need a referral to see a specialist Cost Original Medicare: You usually pay 20% of the Medicare approved amount after you meet your deductible for Part B - covered services. Also known as your coinsurance You will pay a monthly premium for Part B and a separate premium for Part D if you also choose Medicare drug coverage There is no yearly limit on what you pay out of pocket, unless you have supplemental coverage You can purchase Medigap to help pay out - of - pocketcosts not covered by Medicare like your 20% coinsurance Medicare Advantage (Part C): Plans have different out - of - pocket costs for certain services You pay the Part B premium and may also have a premium for the plan. Some have a $0 premium and may help pay all or part of you Part B premium. Most plans include Medicare drug coverage (Part D) Plans have a yearly limit on Part A and Part B covered services as well as different limits for in - network and out - of - network services Medigap is not available to purchase

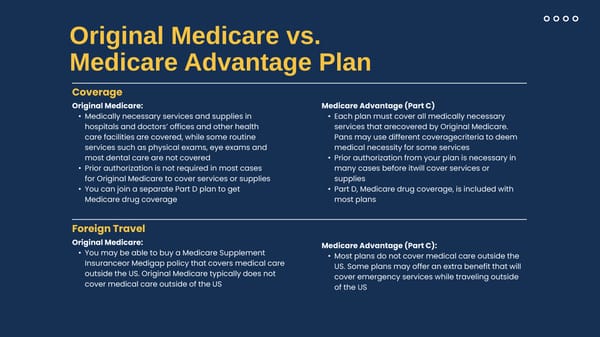

Original Medicare vs. Medicare Advantage Plan Coverage Original Medicare: Medically necessary services and supplies in hospitals and doctors offices and other health care facilities are covered, while some routine services such as physical exams, eye exams and most dental care are not covered Prior authorization is not required in most cases for Original Medicare to cover services or supplies You can join a separate Part D plan to get Medicare drug coverage Medicare Advantage (Part C) Each plan must cover all medically necessary services that arecovered by Original Medicare. Pans may use different coveragecriteria to deem medical necessity for some services Prior authorization from your plan is necessary in many cases before itwill cover services or supplies Part D, Medicare drug coverage, is included with most plans Foreign Travel Original Medicare: You may be able to buy a Medicare Supplement Insuranceor Medigap policy that covers medical care outside the US. Original Medicare typically does not cover medical care outside of the US Medicare Advantage (Part C): Most plans do not cover medical care outside the US. Some plans may offer an extra benefit that will cover emergency services while traveling outside of the US

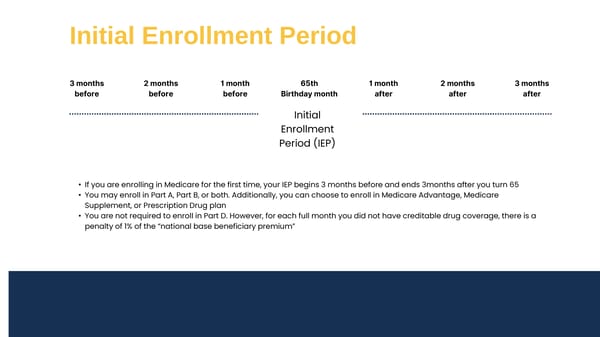

3 months before Initial Enrollment Period 2 months before 1 month before 65th Birthday month 1 month after 2 months after 3 months after Initial Enrollment Period (IEP) If you are enrolling in Medicare for the first time, your IEP begins 3 months before and ends 3months after you turn 65 You may enroll in Part A, Part B, or both. Additionally, you can choose to enroll in Medicare Advantage, Medicare Supplement, or Prescription Drug plan You are not required to enroll in Part D. However, for each full month you did not have creditable drug coverage, there is a penalty of 1% of the national base beneficiary premium

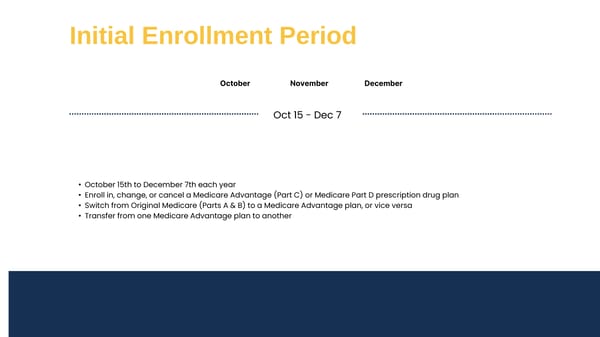

Initial Enrollment Period October November December Oct 15 - Dec 7 October 15th to December 7th each year Enroll in, change, or cancel a Medicare Advantage (Part C) or Medicare Part D prescription drug plan Switch from Original Medicare (Parts A & B) to a Medicare Advantage plan, or vice versa Transfer from one Medicare Advantage plan to another

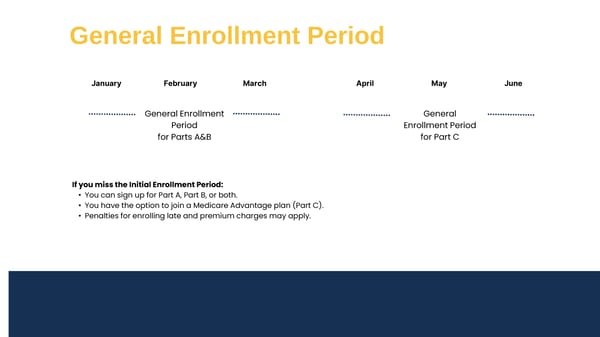

January General Enrollment Period February March April May June General Enrollment Period for Parts A&B If you miss the Initial Enrollment Period: You can sign up for Part A, Part B, or both. You have the option to join a Medicare Advantage plan (Part C). Penalties for enrolling late and premium charges may apply. General Enrollment Period for Part C

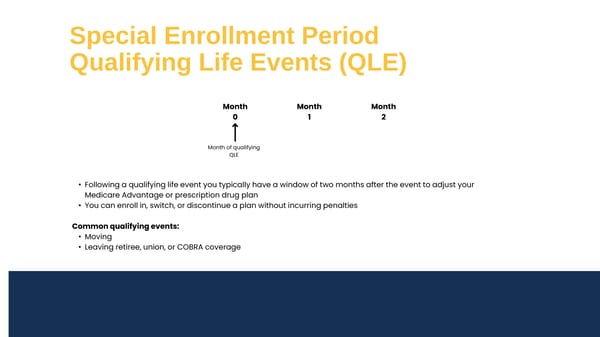

Special Enrollment Period Qualifying Life Events (QLE) Month 0 Month 1 Month 2 Following a qualifying life event you typically have a window of two months after the event to adjust your Medicare Advantage or prescription drug plan You can enroll in, switch, or discontinue a plan without incurring penalties Common qualifying events: Moving Leaving retiree, union, or COBRA coverage Month of qualifying QLE

Visit www.medicare.gov Call 1 - 800 - MEDICARE (1 - 800 - 633 - 4227), TTY 1 - 877 - 486 - 2048, 24 hours a day, 7 days a week State Health Insurance Assistance Program (SHIP); get the number at www.shiphelp.org Your local Social Security or state Medicaid office Resources

Thank you for your time! Eric Willhite Medicare Advisor Meridian Risk Management 203 - 676 - 1235 ejw@meridianrisk.com