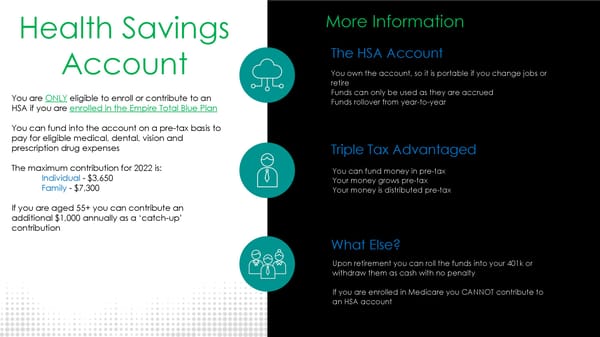

Health Savings More Information Account The HSA Account You own the account, so it is portable if you change jobs or retire You are ONLYeligible to enroll or contribute to an Funds can only be used as they are accrued HSA if you are enrolled in the Empire Total Blue Plan Funds rollover from year-to-year You can fund into the account on a pre-tax basis to pay for eligible medical, dental, vision and prescription drug expenses Triple Tax Advantaged The maximum contribution for 2022 is: You can fund money in pre-tax Individual - $3,650 Your money grows pre-tax Family - $7,300 Your money is distributed pre-tax If you are aged 55+ you can contribute an additional $1,000 annually as a ‘catch-up’ contribution What Else? Upon retirement you can roll the funds into your 401k or withdraw them as cash with no penalty If you are enrolled in Medicare you CANNOT contribute to an HSA account

Open Enrollment Template Page 16 Page 18

Open Enrollment Template Page 16 Page 18