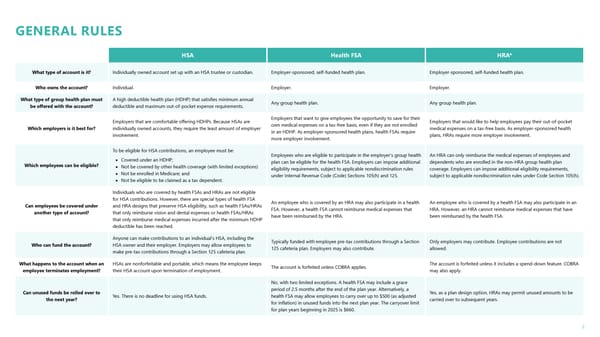

2 HSA Health FSA HRA* What type of account is it? Individually owned account set up with an HSA trustee or custodian. Employer-sponsored, self-funded health plan. Employer-sponsored, self-funded health plan. Who owns the account? Individual. Employer. Employer. What type of group health plan must be offered with the account? A high deductible health plan (HDHP) that satisfies minimum annual deductible and maximum out-of-pocket expense requirements. Any group health plan. Any group health plan. Which employers is it best for? Employers that are comfortable offering HDHPs. Because HSAs are individually owned accounts, they require the least amount of employer involvement. Employers that want to give employees the opportunity to save for their own medical expenses on a tax-free basis, even if they are not enrolled in an HDHP. As employer-sponsored health plans, health FSAs require more employer involvement. Employers that would like to help employees pay their out-of-pocket medical expenses on a tax-free basis. As employer-sponsored health plans, HRAs require more employer involvement. Which employees can be eligible? To be eligible for HSA contributions, an employee must be: • Covered under an HDHP; • Not be covered by other health coverage (with limited exceptions) • Not be enrolled in Medicare; and • Not be eligible to be claimed as a tax dependent. Employees who are eligible to participate in the employer’s group health plan can be eligible for the health FSA. Employers can impose additional eligibility requirements, subject to applicable nondiscrimination rules under Internal Revenue Code (Code) Sections 105(h) and 125. An HRA can only reimburse the medical expenses of employees and dependents who are enrolled in the non-HRA group health plan coverage. Employers can impose additional eligibility requirements, subject to applicable nondiscrimination rules under Code Section 105(h). Can employees be covered under another type of account? Individuals who are covered by health FSAs and HRAs are not eligible for HSA contributions. However, there are special types of health FSA and HRA designs that preserve HSA eligibility, such as health FSAs/HRAs that only reimburse vision and dental expenses or health FSAs/HRAs that only reimburse medical expenses incurred after the minimum HDHP deductible has been reached. An employee who is covered by an HRA may also participate in a health FSA. However, a health FSA cannot reimburse medical expenses that have been reimbursed by the HRA. An employee who is covered by a health FSA may also participate in an HRA. However, an HRA cannot reimburse medical expenses that have been reimbursed by the health FSA. Who can fund the account? Anyone can make contributions to an individual’s HSA, including the HSA owner and their employer. Employers may allow employees to make pre-tax contributions through a Section 125 cafeteria plan. Typically funded with employee pre-tax contributions through a Section 125 cafeteria plan. Employers may also contribute. Only employers may contribute. Employee contributions are not allowed. What happens to the account when an employee terminates employment? HSAs are nonforfeitable and portable, which means the employee keeps their HSA account upon termination of employment. The account is forfeited unless COBRA applies. The account is forfeited unless it includes a spend-down feature. COBRA may also apply. Can unused funds be rolled over to the next year? Yes. There is no deadline for using HSA funds. No, with two limited exceptions. A health FSA may include a grace period of 2.5 months after the end of the plan year. Alternatively, a health FSA may allow employees to carry over up to $500 (as adjusted for inflation) in unused funds into the next plan year. The carryover limit for plan years beginning in 2025 is $660. Yes, as a plan design option, HRAs may permit unused amounts to be carried over to subsequent years. GENERAL RULES

Comparison of HSAs, Health FSAs and HRAs Page 1 Page 3

Comparison of HSAs, Health FSAs and HRAs Page 1 Page 3