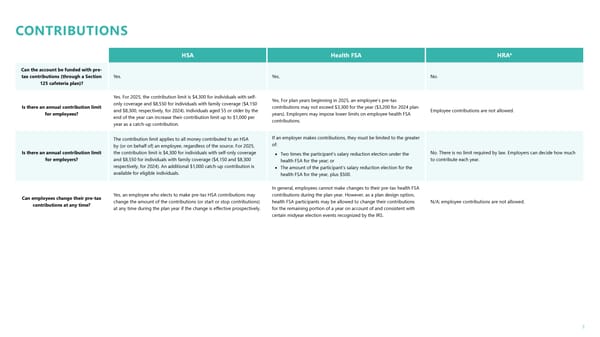

3 HSA Health FSA HRA* Can the account be funded with pre- tax contributions (through a Section 125 cafeteria plan)? Yes. Yes. No. Is there an annual contribution limit for employees? Yes. For 2025, the contribution limit is $4,300 for individuals with self- only coverage and $8,550 for individuals with family coverage ($4,150 and $8,300, respectively, for 2024). Individuals aged 55 or older by the end of the year can increase their contribution limit up to $1,000 per year as a catch-up contribution. Yes. For plan years beginning in 2025, an employee’s pre-tax contributions may not exceed $3,300 for the year ($3,200 for 2024 plan years). Employers may impose lower limits on employee health FSA contributions. Employee contributions are not allowed. Is there an annual contribution limit for employers? The contribution limit applies to all money contributed to an HSA by (or on behalf of) an employee, regardless of the source. For 2025, the contribution limit is $4,300 for individuals with self-only coverage and $8,550 for individuals with family coverage ($4,150 and $8,300 respectively, for 2024). An additional $1,000 catch-up contribution is available for eligible individuals. If an employer makes contributions, they must be limited to the greater of: • Two times the participant’s salary reduction election under the health FSA for the year; or • The amount of the participant’s salary reduction election for the health FSA for the year, plus $500. No. There is no limit required by law. Employers can decide how much to contribute each year. Can employees change their pre-tax contributions at any time? Yes, an employee who elects to make pre-tax HSA contributions may change the amount of the contributions (or start or stop contributions) at any time during the plan year if the change is effective prospectively. In general, employees cannot make changes to their pre-tax health FSA contributions during the plan year. However, as a plan design option, health FSA participants may be allowed to change their contributions for the remaining portion of a year on account of and consistent with certain midyear election events recognized by the IRS. N/A; employee contributions are not allowed. CONTRIBUTIONS

Comparison of HSAs, Health FSAs and HRAs Page 2 Page 4

Comparison of HSAs, Health FSAs and HRAs Page 2 Page 4