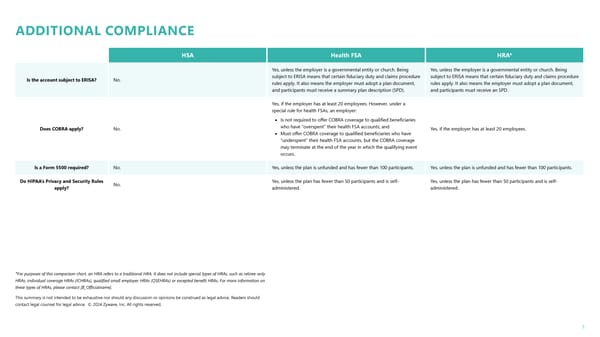

5 HSA Health FSA HRA* Is the account subject to ERISA? No. Yes, unless the employer is a governmental entity or church. Being subject to ERISA means that certain fiduciary duty and claims procedure rules apply. It also means the employer must adopt a plan document, and participants must receive a summary plan description (SPD). Yes, unless the employer is a governmental entity or church. Being subject to ERISA means that certain fiduciary duty and claims procedure rules apply. It also means the employer must adopt a plan document, and participants must receive an SPD. Does COBRA apply? No. Yes, if the employer has at least 20 employees. However, under a special rule for health FSAs, an employer: • Is not required to offer COBRA coverage to qualified beneficiaries who have “overspent” their health FSA accounts; and • Must offer COBRA coverage to qualified beneficiaries who have “underspent” their health FSA accounts, but the COBRA coverage may terminate at the end of the year in which the qualifying event occurs. Yes, if the employer has at least 20 employees. Is a Form 5500 required? No. Yes, unless the plan is unfunded and has fewer than 100 participants. Yes, unless the plan is unfunded and has fewer than 100 participants. Do HIPAA’s Privacy and Security Rules apply? No. Yes, unless the plan has fewer than 50 participants and is self- administered. Yes, unless the plan has fewer than 50 participants and is self- administered. ADDITIONAL COMPLIANCE *For purposes of this comparison chart, an HRA refers to a traditional HRA. It does not include special types of HRAs, such as retiree-only HRAs, individual coverage HRAs (ICHRAs), qualified small employer HRAs (QSEHRAs) or excepted benefit HRAs. For more information on these types of HRAs, please contact [B_Officialname]. This summary is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. © 2024 Zywave, Inc. All rights reserved.

Comparison of HSAs, Health FSAs and HRAs Page 4

Comparison of HSAs, Health FSAs and HRAs Page 4