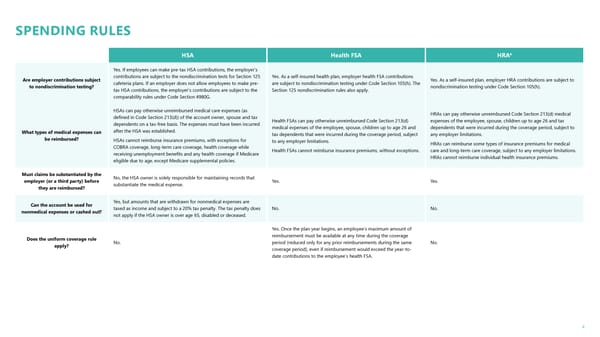

4 HSA Health FSA HRA* Are employer contributions subject to nondiscrimination testing? Yes. If employees can make pre-tax HSA contributions, the employer’s contributions are subject to the nondiscrimination tests for Section 125 cafeteria plans. If an employer does not allow employees to make pre- tax HSA contributions, the employer’s contributions are subject to the comparability rules under Code Section 4980G. Yes. As a self-insured health plan, employer health FSA contributions are subject to nondiscrimination testing under Code Section 105(h). The Section 125 nondiscrimination rules also apply. Yes. As a self-insured plan, employer HRA contributions are subject to nondiscrimination testing under Code Section 105(h). What types of medical expenses can be reimbursed? HSAs can pay otherwise unreimbursed medical care expenses (as defined in Code Section 213(d)) of the account owner, spouse and tax dependents on a tax-free basis. The expenses must have been incurred after the HSA was established. HSAs cannot reimburse insurance premiums, with exceptions for COBRA coverage, long-term care coverage, health coverage while receiving unemployment benefits and any health coverage if Medicare eligible due to age, except Medicare supplemental policies. Health FSAs can pay otherwise unreimbursed Code Section 213(d) medical expenses of the employee, spouse, children up to age 26 and tax dependents that were incurred during the coverage period, subject to any employer limitations. Health FSAs cannot reimburse insurance premiums, without exceptions. HRAs can pay otherwise unreimbursed Code Section 213(d) medical expenses of the employee, spouse, children up to age 26 and tax dependents that were incurred during the coverage period, subject to any employer limitations. HRAs can reimburse some types of insurance premiums for medical care and long-term care coverage, subject to any employer limitations. HRAs cannot reimburse individual health insurance premiums. Must claims be substantiated by the employer (or a third party) before they are reimbursed? No, the HSA owner is solely responsible for maintaining records that substantiate the medical expense. Yes. Yes. Can the account be used for nonmedical expenses or cashed out? Yes, but amounts that are withdrawn for nonmedical expenses are taxed as income and subject to a 20% tax penalty. The tax penalty does not apply if the HSA owner is over age 65, disabled or deceased. No. No. Does the uniform coverage rule apply? No. Yes. Once the plan year begins, an employee’s maximum amount of reimbursement must be available at any time during the coverage period (reduced only for any prior reimbursements during the same coverage period), even if reimbursement would exceed the year-to- date contributions to the employee’s health FSA. No. SPENDING RULES

Comparison of HSAs, Health FSAs and HRAs Page 3 Page 5

Comparison of HSAs, Health FSAs and HRAs Page 3 Page 5