Saint Joseph's Medical Center Open Enrollment 2021 - R

Open Enrollment 2021

WELCOME TO OPEN ENROLLMENT 2

WELCOME TO OPEN ENROLLMENT Welcome to Open Enrollment Life & AD&D ▪ Eligibility ▪ Qualifying Events Financial ▪ Open Enrollment Period ▪ Flexible Spending Accounts Benefits Overview ▪ Commuter Benefits Q&A & Disclosures Medical ▪ Key Terms ▪ Preventative Care ▪ BP001 PPO ▪ BP003 EPO ▪ Rightway ▪ Telemedicine Dental 3

KEY ITEMS ELIGIBILITY QUALIFYING EVENT All full time employees are eligible to Eligible employees may enroll or make enroll in the Saint Joseph’s Medical changes to their benefit elections Center benefit plans. during open enrollment. These The following family members are elections will hold for the entire year, eligible for the medical, dental and unless you have a qualifying event, vision programs. such as listed below. ▪ Spouse ▪ Marriage ▪ Dependent Children ▪ Divorce ▪ Dependent Step Children ▪ Legal Separation ▪ Birth of a Child ▪ Adoption ▪ Loss of other coverage 4

OPEN ENROLLMENT PERIOD Important Notes HOW & WHEN TO ENROLL? Open Enrollment Your current coverage elections for Medical and Dental WILL automatically November 30, 2020 –December 16, 2020 rollover, if you do not elect to make Plan Dates changes in Employee Navigator January 1, 2021 – December 31, 2021 Your current Healthcare Flexible Spending Account, Dependent Care Enrollment Portal Flexible Spending Account and www.employeenavigator.com Commuter Benefits WILL NOT automatically rollover. You must Company Identifier actively reelect these coverages in Employee Navigator ‘SJMC’ 5

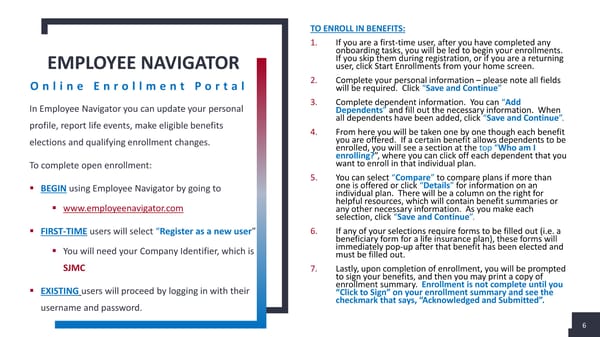

TO ENROLL IN BENEFITS: 1. If you are a first-time user, after you have completed any onboarding tasks, you will be led to begin your enrollments. If you skip them during registration, or if you are a returning EMPLOYEE NAVIGATOR user, click Start Enrollments from your home screen. Online Enrollment Portal 2. Complete your personal information – please note all fields will be required. Click “Save and Continue” In Employee Navigator you can update your personal 3. Complete dependent information. You can “Add Dependents” and fill out the necessary information. When profile, report life events, make eligible benefits all dependents have been added, click “Save and Continue”. 4. From here you will be taken one by one though each benefit elections and qualifying enrollment changes. you are offered. If a certain benefit allows dependents to be enrolled, you will see a section at the top “Who am I enrolling?”, where you can click off each dependent that you To complete open enrollment: want to enroll in that individual plan. 5. You can select “Compare” to compare plans if more than ▪ BEGINusing Employee Navigator by going to one is offered or click “Details” for information on an individual plan. There will be a column on the right for ▪ www.employeenavigator.com helpful resources, which will contain benefit summaries or any other necessary information. As you make each selection, click “Save and Continue”. ▪ FIRST-TIMEusers will select “Register as a new user” 6. If any of your selections require forms to be filled out (i.e. a beneficiary form for a life insurance plan), these forms will ▪ You will need your Company Identifier, which is immediately pop-up after that benefit has been elected and must be filled out. SJMC 7. Lastly, upon completion of enrollment, you will be prompted to sign your benefits, and then you may print a copy of ▪ EXISTINGusers will proceed by logging in with their enrollment summary. Enrollment is not complete until you “Click to Sign” on your enrollment summary and see the username and password. checkmark that says, “Acknowledged and Submitted”. 6

BENEFITS OVERVIEW Add a Footer 7

BENEFITS OVERVIEW Coverage Carrier Contact Number Website Medical Network Empire BCBS 800-626-3643 www.empireblue.com Medical Claims Processor International Benefits Administrator 877-390-2501 www.ibatpa.com Prescription Drugs OptumRx 800-356-3477 www.optumrx.com Medical Concierge Service RightwayHealth 917-594-6886 www.rightwayhealthcare.com Telemedicine LiveHealth Online 1-844-784-8409 www.livehealthonline.com Dental Delta Dental 630-574-6001 www.deltadental.com Life Insurance Reliance Standard 800-351-7500 www.reliancestandard.com FSA & Commuter Benefits PrimePay 1-877-479-2992 www.primepay.com 8 8

MEDICAL 9

KEY TERMS Annual Deductible Out-of-Pocket Copays/Coinsurance Maximum The amount you have to pay each year The total amount you can pay These expenses are your share of the before the plan starts paying a portion out of pocket each year before cost paid for covered health care of the medical expenses. the plan pays 100 percent of services. Embedded (E) –Each covered family covered expenses for the rest of Copays–A fixed dollar amount, usually member only needs to satisfy their the year. due at the time you receive care. individual deductible, not the entire Most expenses that meet Coinsurance – A percentage share of family deductible prior to receiving provider network requirements the allowed amount charged for the plan benefits. count toward the annual out-of- service. It is generally billed to you after Non-Embedded (A) –The entire family pocket maximum, including the health insurance company has deductible must be satisfied before expenses paid to the annual reconciled the bill with the provider. copays/coinsurance is applied to any deductible, copays and family member. coinsurance. 10

Examples of Preventative Services: ▪ Routine Physicals PREVENTATIVE CARE ▪ Well Baby & Child Care Visits What is covered? ▪ Well Women Visits ▪ Immunizations ▪ Routine Bone Density Test Under all of Saint Joseph’s Medical Center medical plans you are eligible to receive routine preventative and ▪ Routine Breast Exam wellness services at no cost. ▪ Routine Gynecological Exam ▪ Obesity Screening & Counseling ▪ No cost means: ▪ Routine Digital Rectal Exam ▪ No deductibles ▪ Routine Colonoscopy ▪ Routine Colorectal Cancer Screening ▪ No copays ▪ Routine Prostate Test ▪ No coinsurance ▪ Routine Mammograms ▪ Routine Pap Smear Preventative Care Flyer ▪ Health Counseling for STD’s & HIV ▪ Testing for HPV & HIV ▪ Screening & Counseling for Domestic Abuse 11

EMPIRE PPO BP001 PLAN Services Tier 1 – SJMC Providers Tier 2 - Empire Network Tier 3 – Out-of-Network Network Annual Deductible Individual - $0 (E) Individual - $50 (E) Individual - $400 (E) ▪ Empire BlueCard PPO Family - $0 (E) Family - $100 (E) Family - $950 (E) Out-of-Pocket Maximum Individual - $0 (E) Individual - $6,350 (E) Individual - $2,400 (E) Plan Family - $0 (E) Family - $12,700 (E) Family - $5,950 (E) Primary Care & Specialist Visit No Charge $20 Copay 20% Coinsurance ▪ 1/1/2021 –12/31/2021 Urgent Care & Walk-In Visits No Charge $20 Copay 20% Coinsurance Emergency Room Visit No Charge $50 Copay 20% Coinsurance Provider Search Labs No Charge No Charge 20% Coinsurance www.empireblue.com Radiology No Charge No Charge 20% Coinsurance High-Cost Diagnostics No Charge No Charge 20% Coinsurance Additional Information In-Patient Hospitalization No Charge No Charge 20% Coinsurance ▪ Benefits Summary Out-Patient Surgery No Charge No Charge 20% Coinsurance Durable Medical Equipment No Charge No Charge 20% Coinsurance ▪ Sydney Flyer Prescription Drugs Tier 1 $5 $5 Not Covered ▪ COVID Test Locator Tier 2 $15 $15 Not Covered Tier 3 $25 $25 Not Covered Mail Order 2x Retail 2x Retail Not Covered 12 12

EMPIRE EPO BP003 PLAN Services Tier 1 – SJMC Providers Tier 2 - Empire Network Network Annual Deductible Individual - $0 (E) Individual - $50 (E) ▪ Empire BlueCard EPO Family - $0 (E) Family - $100 (E) Out-of-Pocket Maximum Individual - $0 (E) Individual - $6,350 (E) Plan Family - $0 (E) Family - $12,700 (E) Primary Care & Specialist Visit No Charge $30 Copay ▪ 1/1/2021 –12/31/2021 Urgent Care & Walk-In Visits No Charge $30 Copay Emergency Room Visit No Charge $50 Copay Provider Search Labs No Charge No Charge www.empireblue.com Radiology No Charge No Charge High-Cost Diagnostics No Charge No Charge Additional Information In-Patient Hospitalization No Charge $100 Copay up to $250 Per Year ▪ Benefits Summary Out-Patient Surgery No Charge No Charge Durable Medical Equipment No Charge No Charge ▪ Sydney Flyer Prescription Drugs Tier 1 $10 $10 ▪ COVID Test Locator Tier 2 $20 $20 Tier 3 $30 $30 Mail Order 2x Retail 2x Retail 13 13

RIGHTWAYHEALTHCARE What is Rightway? ▪ Rightwayis a healthcare concierge service with many benefits. Through Rightway, you will be able to: ▪ Contact your own personal navigator via phone, email or chat. ▪ Navigators are all MDs, ARNPs, or Nurses ▪ Find a provider ▪ Schedule your doctor appointments ▪ Understand your benefits ▪ Compare prescription costs ▪ Resolve medical bills ▪ Receive support for care decisions RightwayHealth Concierge Flyer 14

What are some common issues where I would use LiveHealth Online ? TELEMEDICINE ▪ Cold What is Telemedicine? ▪ Flu ▪ Sinus Infection ▪ Allergies Under the Saint Joseph’s Medical Center medical plans when you need to see a doctor you can use LiveHealth ▪ Pink Eye Online to video visit with a board certified doctor 24/7 ▪ Ear Infections 365 days a year from a smartphone, tablet or computer LiveHealth Online Psychology with a webcam. ▪ Stress With LiveHealth Online ▪ Anxiety ▪ Depression ▪ You receive immediate access to doctors 24/7 ▪ Prescriptions can be sent to a pharmacy of your How Much Does It Cost? choice The cost of LiveHealth Online visit is a zero, so less expensive than a LiveHealthOnline Flyer primary care, urgent care or emergency room visit and likely more convenient. 15

DENTAL 16

DELTA DENTAL PLAN Services Delta DHMO Network In-Network ▪ Delta Dental TOA Deductible Individual: $50 Family: $150 Plan Preventative Services ▪ 1/1/2021 –12/31/2021 Cleanings X-Rays Subject to Fee Schedule Provider Search Oral Exams Space Maintainers www.deltadental.com Sealants Basic Services Additional Information Fillings Subject to Fee Schedule ▪ Table of Allowance Simple Tooth Extractions Schedule Major Services Periodontics / Endodontics Oral Surgery Subject to Fee Schedule Crowns / Inlays / Onlays / TMJ Prosthodontics – Bridges, Dentures and Implants Annual Maximum $1,000 17 17

LIFE & AD&D 18

LIFE INSURANCE Life & AD&D Beneficiary Designation ▪ Life & Accidental Death & ▪ Please review your current Dismemberment Insurance is beneficiary information contained in provided to you by Saint Joseph’s Employee Navigator to ensure it is Medical Center up to date and accurate ▪ Saint Joseph’s Medical Center pays the full cost of the benefit www.employeenavigator.com ▪ Please review Employee Navigator to see your coverage amount www.employeenavigator.com 19

FINANCIAL 20

FLEXIBLE SPENDING ACCOUNT HEALTH CARE FSA DEPENDENT CARE FSA ▪ Administered by PrimePay ▪ Administered by PrimePay ▪ You may contribute up to $2,750 per year to pay for eligible ▪ You may contribute up to $5,000 ($2,500 if married and medical, Rx, dental and vision expenses filing taxes separately) to pay for eligible dependent care ▪ Funds are available to you on the first day of the plan year expenses. ▪ You can roll over up to $550 of unused funds into the 2022 ▪ Funds are available as you accrue them in the account. plan year ▪ You cannot roll over any unused funds into the 2022 plan ▪ Any amounts over $550 in the account would be forfeit under year the ‘use it or lose it’ rule ▪ Any unused funds would be forfeit under the ‘use it or lose it’ rule. Please note your current coverage elections WILL NOT automatically rollover 21 21

FINANCIAL CONTINUED Commuter Benefits ▪ Administered by PrimePay ▪ You may contribute up to $270 per month pre-tax to pay for parking or transportation. ▪ Funds are loaded on to a debit card to pay for Transit and Parking expenses 22

Q&A + DISCLOSURES Add a Footer 23

Q&A WHAT/WHERE/WHEN? WHAT? ▪ You must enroll or waive out of the coverages via Employee Navigator. Medical and Dental election will automatically rollover. FSA, DCFSA and Commuter will not automatically rollover. WHERE? ▪ Login to www.employeenavigator.com WHEN? ▪ Complete elections no later than December 16, 2020 NOTICES & DISCLOSURES ▪ Click to view the appropriate notices and disclosures 24

ACCOUNT TEAM Tom Clements Joe Marino Consultant Senior Account Manager 203-339-2735 914-368-1291 tc@meridianrisk.com jmm@meridianrisk.com 25

THANK YOU 26