Sample Open Enrollment Presentation

Open Enrollment

WELCOME TO OPEN ENROLLMENT 2

WELCOME TO OPEN ENROLLMENT Welcome to Open Enrollment Voluntary Vision ▪ Eligibility ▪ Qualifying Events Life & AD&D ▪ Open Enrollment Period ▪ How to Enroll Benefits Overview Disability Medical Financial ▪ Key Terms ▪ Health Savings Account ▪ Preventative Care ▪ Base Plan Contributions ▪ Buy-Up Plan ▪ Meet Alex ▪ Telemedicine Q&A & Disclosures ▪ Anthem Programs Account Team Dental 3

ELIGIBILITY QUALIFYING EVENT All full time employees working 30 hours Eligible employees may enroll or make or more per week are eligible to enroll in changes to their benefit elections the Meridian Risk Management medical, during open enrollment. These dental, and vision benefit plans. elections will hold for the entire year, Employees working 30 hours per week are unless you have a qualifying event, automatically enrolled in the life and such as listed below. short-term disability plans. The following family members are eligible ▪ Marriage for the medical, dental and vision ▪ Divorce programs. ▪ Legal Separation ▪ Spouse ▪ Birth of a Child ▪ Dependent Children ▪ Adoption ▪ Dependent Step Children ▪ Loss of other coverage 4

OPEN ENROLLMENT PERIOD HOW & WHEN TO ENROLL? Open Enrollment May 14, 2021 – May 21, 2021 Plan Dates July 1, 2021 – June 30, 2022 How to Enroll 5

BENEFITS OVERVIEW 6

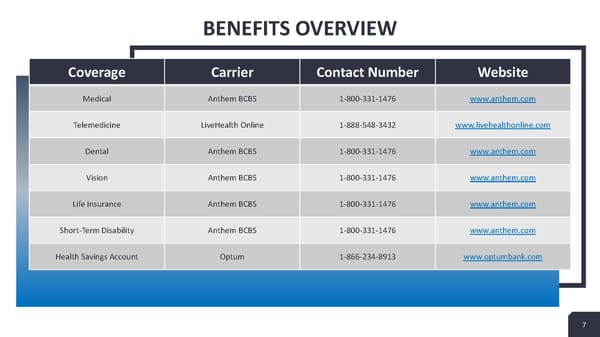

BENEFITS OVERVIEW Coverage Carrier Contact Number Website Medical Anthem BCBS 1-800-331-1476 www.anthem.com Telemedicine LiveHealth Online 1-888-548-3432 www.livehealthonline.com Dental Anthem BCBS 1-800-331-1476 www.anthem.com Vision Anthem BCBS 1-800-331-1476 www.anthem.com Life Insurance Anthem BCBS 1-800-331-1476 www.anthem.com Short-Term Disability Anthem BCBS 1-800-331-1476 www.anthem.com Health Savings Account Optum 1-866-234-8913 www.optumbank.com 7 7

MEDICAL 8

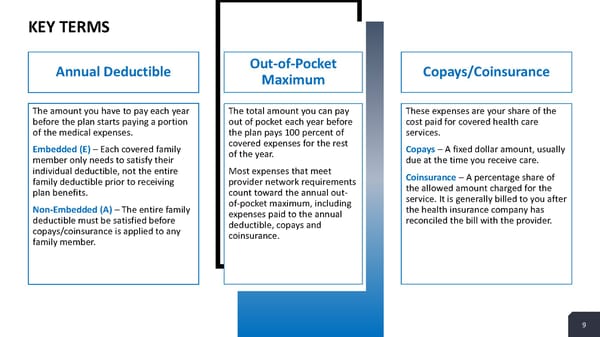

KEY TERMS Annual Deductible Out-of-Pocket Copays/Coinsurance Maximum The amount you have to pay each year The total amount you can pay These expenses are your share of the before the plan starts paying a portion out of pocket each year before cost paid for covered health care of the medical expenses. the plan pays 100 percent of services. Embedded (E) –Each covered family covered expenses for the rest Copays–A fixed dollar amount, usually member only needs to satisfy their of the year. due at the time you receive care. individual deductible, not the entire Most expenses that meet Coinsurance – A percentage share of family deductible prior to receiving provider network requirements the allowed amount charged for the plan benefits. count toward the annual out- service. It is generally billed to you after Non-Embedded (A) –The entire family of-pocket maximum, including the health insurance company has deductible must be satisfied before expenses paid to the annual reconciled the bill with the provider. copays/coinsurance is applied to any deductible, copays and family member. coinsurance. 9

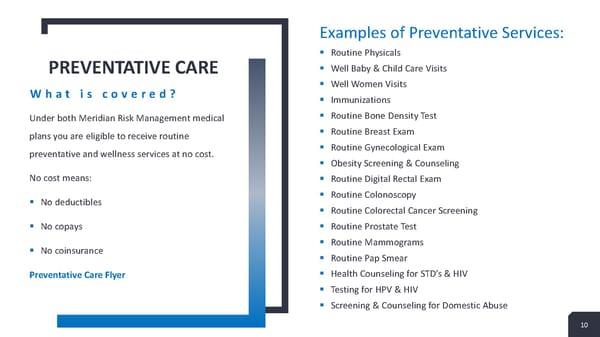

Examples of Preventative Services: ▪ Routine Physicals PREVENTATIVE CARE ▪ Well Baby & Child Care Visits What is covered? ▪ Well Women Visits ▪ Immunizations Under both Meridian Risk Management medical ▪ Routine Bone Density Test plans you are eligible to receive routine ▪ Routine Breast Exam preventative and wellness services at no cost. ▪ Routine Gynecological Exam ▪ Obesity Screening & Counseling No cost means: ▪ Routine Digital Rectal Exam ▪ No deductibles ▪ Routine Colonoscopy ▪ Routine Colorectal Cancer Screening ▪ No copays ▪ Routine Prostate Test ▪ No coinsurance ▪ Routine Mammograms ▪ Routine Pap Smear Preventative Care Flyer ▪ Health Counseling for STD’s & HIV ▪ Testing for HPV & HIV ▪ Screening & Counseling for Domestic Abuse 10

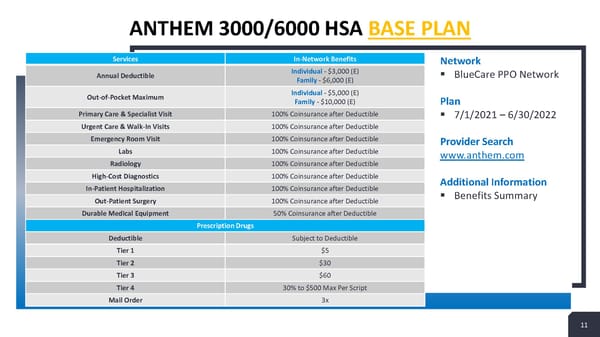

ANTHEM 3000/6000 HSA BASE PLAN Services In-Network Benefits Network Annual Deductible Individual - $3,000 (E) ▪ BlueCare PPO Network Family - $6,000 (E) Out-of-Pocket Maximum Individual - $5,000 (E) Family - $10,000 (E) Plan Primary Care & Specialist Visit 100% Coinsurance after Deductible ▪ 7/1/2021 –6/30/2022 Urgent Care & Walk-In Visits 100% Coinsurance after Deductible Emergency Room Visit 100% Coinsurance after Deductible Provider Search Labs 100% Coinsurance after Deductible www.anthem.com Radiology 100% Coinsurance after Deductible High-Cost Diagnostics 100% Coinsurance after Deductible Additional Information In-Patient Hospitalization 100% Coinsurance after Deductible ▪ Benefits Summary Out-Patient Surgery 100% Coinsurance after Deductible Durable Medical Equipment 50% Coinsurance after Deductible Prescription Drugs Deductible Subject to Deductible Tier 1 $5 Tier 2 $30 Tier 3 $60 Tier 4 30% to $500 Max Per Script Mail Order 3x 11 11

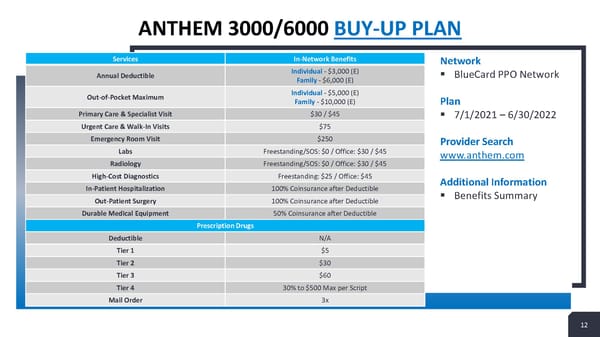

ANTHEM 3000/6000 BUY-UP PLAN Services In-Network Benefits Network Annual Deductible Individual - $3,000 (E) ▪ BlueCard PPO Network Family - $6,000 (E) Out-of-Pocket Maximum Individual - $5,000 (E) Family - $10,000 (E) Plan Primary Care & Specialist Visit $30 / $45 ▪ 7/1/2021 –6/30/2022 Urgent Care & Walk-In Visits $75 Emergency Room Visit $250 Provider Search Labs Freestanding/SOS: $0 / Office: $30 / $45 www.anthem.com Radiology Freestanding/SOS: $0 / Office: $30 / $45 High-Cost Diagnostics Freestanding: $25 / Office: $45 Additional Information In-Patient Hospitalization 100% Coinsurance after Deductible ▪ Benefits Summary Out-Patient Surgery 100% Coinsurance after Deductible Durable Medical Equipment 50% Coinsurance after Deductible Prescription Drugs Deductible N/A Tier 1 $5 Tier 2 $30 Tier 3 $60 Tier 4 30% to $500 Max per Script Mail Order 3x 12 12

MEET ALEX Interested in reviewing which benefit plans may be best for you and maybe having a little fun? Meet Alex… 13

What are some common issues where I TELEMEDICINE would use Telemedicine? What is Telemedicine? ▪ Cold ▪ Flu Anthem members have access to Telemedicine ▪ Sinus Infection visits through LiveHealth Online. You can schedule ▪ Allergies a virtual visit with board certified physicians! ▪ Pink Eye Learn more. ▪ Ear Infections LiveHealth Online Psychology ▪ Stress ▪ Anxiety ▪ Depression How Much Does It Cost? The cost of a virtual visit would typically be less expensive than an specialist, urgent care or emergency room visit. 14

ANTHEM PROGRAMS What is Anthem Wellbeing Solutions? ▪ Wellbeing Coach What are they? ▪ ConditionCare Anthem offers members access to a variety of ▪ Future Moms wellness and wellbeing programs that are ▪ My Health Rewards Activities specifically designed to meet your needs. You can ▪ Sign-up at www.anthem.com earn up to $650 per year in rewards. Sydney App Learn more. ▪ Your personal health guide ▪ Access benefits, member services, wellness services and more ▪ Review claims, view and use digital ID card, get answers from the interactive chat feature Special Offers You qualify for discounts on products and services that help promote better health and wellbeing. 15

DENTAL 16

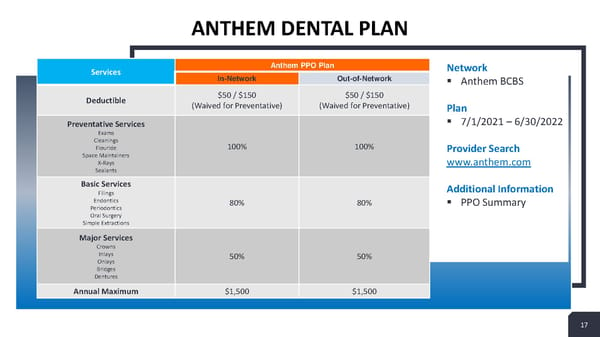

ANTHEM DENTAL PLAN Services Anthem PPO Plan Network In-Network Out-of-Network ▪ Anthem BCBS Deductible $50 / $150 $50 / $150 (Waived for Preventative) (Waived for Preventative) Plan Preventative Services ▪ 7/1/2021 –6/30/2022 Exams Cleanings 100% 100% Flouride Provider Search Space Maintainers X-Rays www.anthem.com Sealants Basic Services Additional Information Filings Endontics 80% 80% ▪ PPO Summary Periodontics Oral Surgery Simple Extractions Major Services Crowns Inlays 50% 50% Onlays Bridges Dentures Annual Maximum $1,500 $1,500 17 17

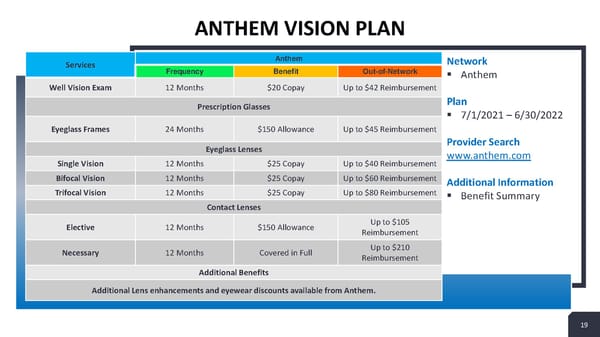

VISION 18

ANTHEM VISION PLAN Services Anthem Network Frequency Benefit Out-of-Network ▪ Anthem Well Vision Exam 12 Months $20 Copay Up to $42 Reimbursement Prescription Glasses Plan ▪ 7/1/2021 –6/30/2022 Eyeglass Frames 24 Months $150 Allowance Up to $45 Reimbursement Eyeglass Lenses Provider Search Single Vision 12 Months $25 Copay Up to $40 Reimbursement www.anthem.com Bifocal Vision 12 Months $25 Copay Up to $60 Reimbursement Additional Information Trifocal Vision 12 Months $25 Copay Up to $80 Reimbursement ▪ Benefit Summary Contact Lenses Elective 12 Months $150 Allowance Up to $105 Reimbursement Necessary 12 Months Covered in Full Up to $210 Reimbursement Additional Benefits Additional Lens enhancements and eyewear discounts available from Anthem. 19 19

LIFE & AD&D 20

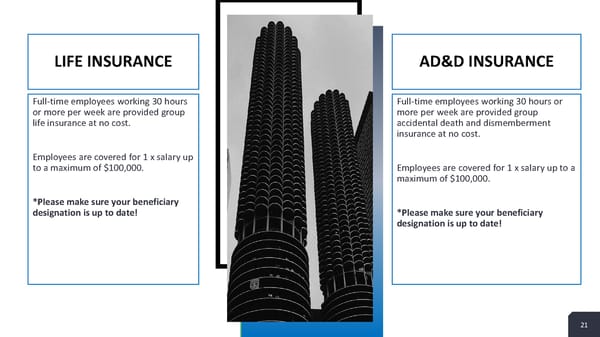

LIFE INSURANCE AD&D INSURANCE Full-time employees working 30 hours Full-time employees working 30 hours or or more per week are provided group more per week are provided group life insurance at no cost. accidental death and dismemberment insurance at no cost. Employees are covered for 1 x salary up to a maximum of $100,000. Employees are covered for 1 x salary up to a maximum of $100,000. *Please make sure your beneficiary designation is up to date! *Please make sure your beneficiary designation is up to date! 21

DISABILITY 22

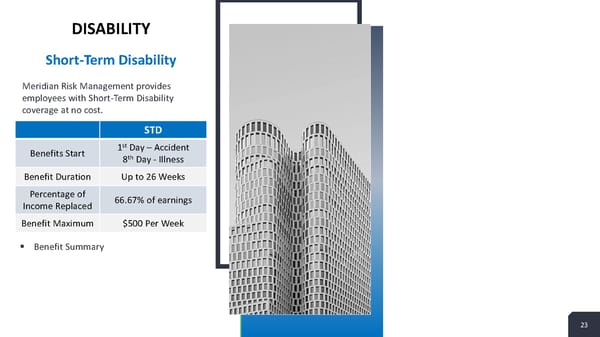

DISABILITY Short-Term Disability Meridian Risk Management provides employees with Short-Term Disability coverage at no cost. STD st Benefits Start 1 Day –Accident th 8 Day -Illness Benefit Duration Up to 26 Weeks Percentage of 66.67% of earnings Income Replaced Benefit Maximum $500 Per Week ▪ Benefit Summary 23

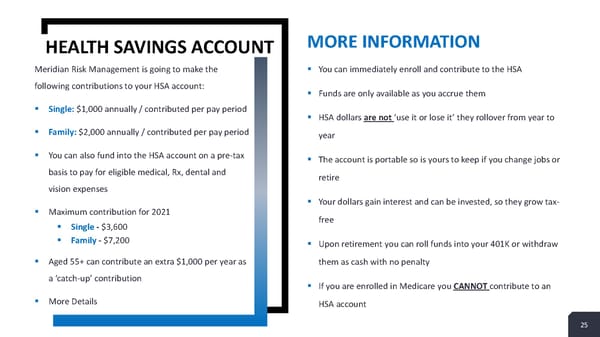

FINANCIAL 24

HEALTH SAVINGS ACCOUNT MORE INFORMATION Meridian Risk Management is going to make the ▪ You can immediately enroll and contribute to the HSA following contributions to your HSA account: ▪ Funds are only available as you accrue them ▪ Single: $1,000 annually / contributed per pay period ▪ HSA dollars are not ‘use it or lose it’ they rollover from year to ▪ Family:$2,000 annually / contributed per pay period year ▪ You can also fund into the HSA account on a pre-tax ▪ The account is portable so is yours to keep if you change jobs or basis to pay for eligible medical, Rx, dental and retire vision expenses ▪ Your dollars gain interest and can be invested, so they grow tax- ▪ Maximum contribution for 2021 free ▪ Single - $3,600 ▪ Family-$7,200 ▪ Upon retirement you can roll funds into your 401K or withdraw ▪ Aged 55+ can contribute an extra $1,000 per year as them as cash with no penalty a ‘catch-up’ contribution ▪ If you are enrolled in Medicare you CANNOT contribute to an ▪ More Details HSA account 25

CONTRIBUTIONS 26

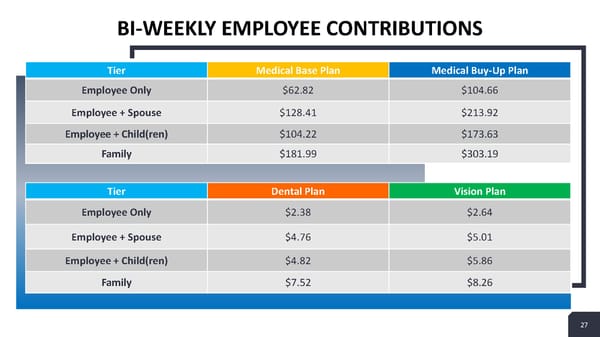

BI-WEEKLY EMPLOYEE CONTRIBUTIONS Tier Medical Base Plan Medical Buy-Up Plan Employee Only $62.82 $104.66 Employee + Spouse $128.41 $213.92 Employee + Child(ren) $104.22 $173.63 Family $181.99 $303.19 Tier Dental Plan Vision Plan Employee Only $2.38 $2.64 Employee + Spouse $4.76 $5.01 Employee + Child(ren) $4.82 $5.86 Family $7.52 $8.26 27 27

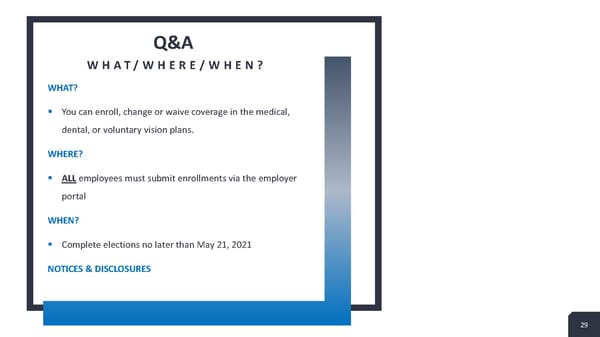

Q&A + DISCLOSURES 28

Q&A WHAT/WHERE/WHEN? WHAT? ▪ You can enroll, change or waive coverage in the medical, dental, or voluntary vision plans. WHERE? ▪ ALLemployees must submit enrollments via the employer portal WHEN? ▪ Complete elections no later than May 21, 2021 NOTICES & DISCLOSURES 29

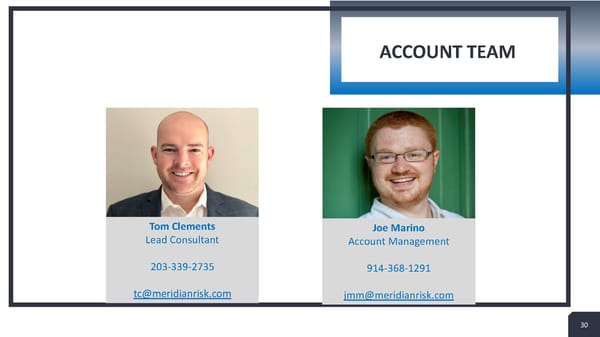

ACCOUNT TEAM Tom Clements Joe Marino Lead Consultant Account Management 203-339-2735 914-368-1291 tc@meridianrisk.com jmm@meridianrisk.com 30

THANK YOU 31