Meridian Risk Unbranded RFP

Employee Benefit Brokerage and Consulting Services Trust comes with experience. In Partnership with: Request for Proposal: Employee Benefit Broker Presented by. 1 Tom Clements Managing Partner

Table of Contents CONTRACTOR INFORMATION 3 EXECUTIVE SUMMARY AND VALUE-ADDED SERVICES 4 MERIDIAN RESPONSE TO SCOPE OF SERVICES 9 ORGANIZATION 9 LEGAL/COMPLIANCE 10 STAFF/TEAM 13 SCOPE OF SERVICES 15 • REQUEST FOR PROPOSAL & PLAN/VENDOR MANAGEMENT 16 • RENEWAL PROCESS 16 • PLAN BENCHMARKING 17 • OPEN ENROLLMENT 18 • COMMUNICATION 19 • WELLNESS 20 • CLIENT RETENTION & EXPERIENCE 21 PERFORMANCE MONITORING 22 • STRATEGIC PLANNING & COST CONTAINMENT 23 • MERIDIAN PERFORMANCE 25 FEES 26 ENCLOSURES 29 2

Executive Summary & Value-Added Services Meridian Risk Management (“Meridian”) is excited to present our response to Iroquois Gas Transmission System, L.P. (“Iroquois”) Request for Proposal: Employee Benefit Broker. Meridian is uniquely qualified to serve Iroquois. We combine decades of experience, expertise and superior analytic tools with hands-on service in health benefits plan design, implementation and communication. Meridian focuses on mid-market organizations, such as Iroquois and has built its practice to provide expertise, technology and the professional support needed by such entities. In addition, Meridian is a member of United Benefit Advisors (UBA) which is an association of the top benefit brokers in the US and made up of over 135 partnering firms with over 2,000+ professionals. Our partnership with UBA provides Meridian with exclusive access to proprietary products, advanced benchmarking and analytics tools, implementation support services and preferred discounts through multiple carriers and vendors. It allows us to combine our personal attention with national UBA support and resources. By partnering with Meridian, Iroquois will benefit from the following: MERIDIAN EXPERIENCE The Meridian team has vast experience working with small to medium sized businesses to manage and service their employee benefit programs. Managing Partner Tom Clements widely regarded as a thought leader in the space and is a regular feature in industry publications. In addition, Tom regularly speaks at industry conventions and is a board advisor to several fin-tech/insure-tech start-ups. When partnering with Meridian we assist in all aspects of benefits plan management, which includes; plan design analysis, carrier/vendor negotiations, plan communication, employee enrollment, strategic planning and ongoing customer service support. NATIONAL AFFILIATIONS – UNITED BENEFIT ADVISORS Meridian is a proud member of United Benefits Advisors. UBA is an invite only group of the most elite employee benefit advisory firms in the world. The UBA relationship fosters collaboration between groups and enables firms to expand their insight and creativity to not only provide extraordinary solutions that mitigate employers’ costs, but also improve the lives of their employees and their families. UBA provides Meridian access to numerous proprietary programs and services as well as access to in-house legal counsel, underwriters and actuaries. The proprietary programs include: level-funded insurance, captive plans and carrier specific offerings. Through these programs, we have been able to save our clients significant dollar amounts which include immediate premium discounts, experience-based refunds and/or administrative credits. 4

DEDICATED ACCOUNT SERVICE We pride ourselves on the level of knowledge and service we provide to our clients. All our clients are assigned a team of specialists dedicated to serving their needs, but each client accesses our team through a single point of contact, making working with us seamless. We have a best in class customer relationship management system containing task tracking and management functions to ensure all aspect of the client relationship are completed in a timely and efficient manner. PLAN DESIGN AND ADMINISTRATION Meridian has vast experience in health and welfare benefit planning and design, specifically for small to medium sized businesses. By using various tools, such as nationally recognized benchmarking data we can assist Iroquois in developing and interpreting their own data and create long- term strategies that will lower overall costs. STRATEGIC PLANNING Meridian will develop a customized strategic plan for Iroquois that defines objectives and outlines the actions needed to accomplish goals. Our services ensure an organized, comprehensive approach to fulfilling your benefits needs. Meridian will partner with Iroquois to provide ongoing analysis, consultation, vendor/industry monitoring along with best in class services to assist Iroquois in their strategic objectives. MANAGING COSTS Our goal when partnering with Iroquois is focused on bringing value to your employee benefits programs. We leverage our expertise, proprietary tools and creative solutions to effectively manage program costs. We will build, implement and manage an action plan to control health care costs while assisting in your promotion of a healthy work environment for you and your employees. 5

ACTUARIAL SUPPORT Our cutting-edge software contains over 100 billion dollars’ worth of claims data and assists in modeling a group’s current plans, shows how plan changes will impact renewal costs and projects what a groups budget would need to be for upcoming year(s). The tools also allow us to assess the likelihood of ‘winning’ through self-funding/level-funding and people migrating from one plan to the other, should multiple plan options be offered. TECHNOLOGY Meridian is at the forefront of current, new and emerging benefits technology that will help our clients operate more efficiently, boost engagement and awareness of benefit programs and ultimately lower both intrinsic and extrinsic costs for employers and employees. Our technology capabilities emulate those used by Fortune 500 companies including multiple benefit administration portals, online enrollment, interactive plan decision tools, OnDemand immersive digital experiences and much more. EMPLOYEE COMMUNICATIONS Address mounting employee benefits communication concerns by using strategies deployed by Fortune 500 companies, including ALEX. Alex is a digital benefits counselor, that guides your employees to the benefit programs that best meet their needs, all with a twist of humor added in. ALEX Benefits Sneak Peek Our Member Experience (MX) presentations make your benefit plans come to life and assist in sending a clear and consistent message out to your employees and their dependents. The presentations are fully customizable and can be adapted for any communication campaign that is desired. For employees, our MX provides 24-hour access to the organization’s benefits information from any computer or mobile device. For employers or digital MX presentations increase engagement, and productivity while providing quantifiable data to craft and refine member messaging. 6

EMPLOYEE EDUCATION Meridian offers our clients numerous education and training opportunities. Our employee focused trainings are designed to help educate employees, promote consumerism, reduce claims leakage and avoid unnecessary high cost expenses. Together with Iroquois we can design, implement and manage programs that best suit you and your employee’s needs. We can conduct trainings across a variety of mediums including; webinars, seminars, digital MX presentations, paper, email, video and mobile app. TOTAL COMPENSATION STATEMENTS In today’s environment recruitment and retention programs are essential to employers. Meridian can help you gauge employee satisfaction and engagement as well as provide customizable total compensation statements to show your employees the true value of the benefits you provide. HUMAN RESOURCES Meridian offers a wide variety of human resources focused services including, access to human resources consultants, ‘living’ employee handbooks, salary benchmarking tools, job description builders and much more. Below is a breakdown of our Live, Comply, and Learn model. - Live – is a HR Hotline that gives you access to on-demand HR expertise and advice. HR professionals are available by phone or email, and are ready to answer your general or state specific HR-related questions. - Comply – offers plan document builders and several other policies and procedures that businesses may need to operate including a living handbook that automatically updates as regulations change. - Learn – provides access to over 350+ online training courses that meet both State and Federal requirements. Our courses are available in both English and Spanish. 7

COMPLIANCE AND LEGISLATION Meridian offers several compliance resources such as multiple ERISA attorneys who will keep you up-to-date with easy-to- understand comprehensive compliance information. Our resources help both employers and employees understand and comply with ever-changing rules and regulations. Our exclusive Legislative Brief publications summarize recent state and federal legislative developments in insurance and employee benefits, to help you understand laws including COBRA, HIPAA, FMLA, ADA, GINA, ACA and more. WORKPLACE WELLNESS Meridian workplace wellness initiatives will reduce health care costs and increase employee productivity and satisfaction. We can implement and manage a customized wellness campaign specific to Iroquois’s objectives and health risks. Through our internal and vendor partners, we can provide wellness information across many verticals which are specifically designed to help you educate and drive participation in your workplace wellness programs. Meridian will take an active role in coordinating wellness fairs and wellness challenges created to focus on all aspects of wellness including physical, behavioral and emotional health. 8

Organization A. Organization 1. Provide your firm’s name and address, and the primary RFP contact’s name, phone number, e- mail address and fax number. 2. Please give an overview of your Company, including a brief history of the firm, years in business, the year the firm began providing benefit brokerage services, and the nature of the firm’s ownership and any affiliated companies or joint ventures. 3. Please provide the location of each of your firm’s offices. Indicate which office would serve this account. 4. Designations your firm holds to operate as a benefits broker i.e., licenses, affiliations etc. Primary Contact Tom Clements – Managing Partner Meridian Risk Management Pelham, NY & Fairfield, CT Phone - 203-339-2735 Fax – 914-636-2752 Email - tc@meridianrisk.com History Meridian Risk Management is a full service, independent, family-owned insurance agency serving the individual and business needs of organizations throughout the United States. Founded in 2003 by Joe Solimine Jr, Meridian specializes in health & welfare, commercial and individual personal lines programs. Meridian is a regional firm with 30+ employees between our two offices in Pelham, NY and Fairfield, CT which makes us small enough to make fast, efficient client wants/needs decisions, but large enough to have the attention of the insurance carriers and compete on a national scale. Meridian is life, accident & health licensed in all 50 states and all employee benefits personnel are required to be licensed, including account managers and customer service representatives, which is something not required by all employee benefit brokerage firms. In 2019, Meridian was accepted into United Benefit Advisors (UBA) which is an association of the country’s most elite independent brokerage firms. Being a member of UBA allows Meridian to offer unique proprietary products, services and pricing advantages that are unavailable to other firms. The UBA relationship fosters collaboration and shared wisdom from over 135 UBA partner firms totaling 2,000+ benefit professionals nationwide. Through our UBA partnership we have ‘boots on the ground’ in almost every state domestically and numerous countries worldwide. The Iroquois relationship would be managed out of both our Fairfield, CT and Pelham, NY offices and is staffed by industry experts that have and will continue to take the time to understand your culture, challenges & goals. You’ll receive tailored solutions that provide you and your employees the very best service and experience you deserve. Our solutions focus on: - Cost Containment - Plan Benchmarking - Compliance Assistance - HR Support - Benefit Administration Systems 9

- Technology Solutions - Member Engagement - Patient Advocacy - Wellness Culture We place high importance on the experience that our customers have during our interactions, while also stressing the importance of giving back, especially where it matters most; close to home. This is reflected by Meridian’s core values and principles: discipline, diligence, honesty and commitment to community. Legal/Compliance B. Legal/Compliance 1. Over the past five years, has your firm or any officer or principal been involved in any business litigation or other legal proceedings related to your services? If yes, please describe nature and outcome 2. Are there any current or pending litigation or administrative actions against your firm? If yes, please describe them. 3. Describe in detail any potential conflicts of interest your firm, affiliates, or parent, may have in management of this account. 4. Describe the coverage levels and insurance carrier of Errors and Omission insurance and/or fiduciary or professional liability insurance carried by your firm. 5. Describe your data security policy, how you handle a data breach and how you ensure that Personally Identifiable Information (PII) is secured within your firm and when sharing between clients and your firm. At Meridian, not only our internal compliance procedures, but the ones we provide to our clients are of the upmost importance. This is demonstrated by the fact that neither Meridian nor our owners have been or are currently involved in any business litigation or legal proceedings related to our services. In the event of a future claim, Westport Insurance Corporation provides us with E&O insurance in the amounts of $10,000,000 per claim and $15,000,000 in aggregate. Internally, Meridian maintains full control over our compliance protocols, policies and service offerings as there are no conflicts, affiliates or parent companies involved that would impede our management of the Iroquois account. Meridian takes HIPAA compliance very seriously and ensures that all business associate agreements are up to date with all clients and vendors that we conduct business with or share PII. We have taken significant steps to ensure that our clients data security measures are best in class. This includes but is not limited to; secure email portals, encryption technology, multi-factor authentication, read-only specific to email addresses etc. In addition, no employees except of those designated to our client’s service team have access to sensitive client information, such as, census data, ben-admin portals etc. In our enclosures is a copy of our standard business associate agreement that outlines how Meridian would handle a data breach in the event one occurred. 10

In addition to our internal compliance policies and procedures Meridian provides our clients with access to several best in class tools and resources. We have expertise to handle every facet of compliance for Iroquois from ERISA, HIPAA, ACA and DOL. Each year Meridian produces an annual compliance calendar that is managed through our CRM system. Our assignment/tracking feature allows us to proactively remind Iroquois of any compliance responsibilities that Meridian cannot handle on their behalf. This ensures that all deadlines are met and allows our clients to rest well in the knowledge that they are complying with all applicable laws. When new legislation is being enacted on both the State and Federal level, we notify Iroquois of the update as well as a plan of action for addressing any new requirements including writing plan modifications and submitting any written reports or other documents required by Federal, State or Local governments. Meridian accesses legislative and HR related information from a variety of sources including ThinkHR, ZyWave, UBA, ERISA attorney’s and several other vendors. As a Zywave partner, we and Iroquois have access to their team of attorneys who analyze ongoing compliance requirements and prepare clear and concise educational briefs on a variety of topics which are contained in their ‘content library’. Our partnership with United Benefit Advisors (UBA) provides us access to their team of in-house attorneys for any ACA or benefits questions that may arise throughout the year. In addition, Meridian utilizes Robinson & Cole as our ERISA attorneys on retainer for any specific client issues that may arise. ThinkHR, MyWave Connect and ZyLearn provides Iroquois with access to three (3) different modules; Live, Comply and Training. Live – provides Iroquois with access to a dedicated HR hotline/web portal that is staffed by multi- disciplined SHRM designated HR consultants. The Live solution allows Iroquois to seek guidance on any HR related questions. The Live team has answered over 500,000 HR related questions and is an invaluable resource for Meridian clients. Comply – provides Iroquois with access to a wide variety of tools including a full compliance library and plan document builder suite. The plan document builder includes a living handbook, that automatically updates any time Federal, State or Local laws change, so you never have to worry about updating your employee handbook again. Train- provides Iroquois with access to over 350 training courses that meet State and Federal certification requirements including, sexual harassment training, OSHA safety, pandemic response etc. These trainings along with several other educational webinars may qualify for SHRM or HRCI continuing education credits. Below is a listing of the many complimentary compliance services we provide to Iroquois: ¨ Access to ThinkHR, MyWave Connect & ZyLearn HR platform ¨ Annual Medicare Part D letters & CMS reporting ¨ Summary Plan Descriptions (SPD Wrap Document) o Summary of Material Modification 11

¨ 5500’s & Summary Annual Report (SAR) – if applicable ¨ Summary of Benefits and Coverage (SBC’s) ¨ COBRA Administration ¨ ACA Model Notices and Annual Model Notices ¨ ACA/ERISA Annual Compliance Calendar ¨ State and Federal Legislative Updates ¨ Business Associate Agreements ¨ Secure PHI portals ¨ HIPAA Training In short, Meridian has gone to great lengths to ensure that our internal and external compliance resources go above and beyond protecting our clients both now and in the future. Experience/Clients C. Experience/Clients 1. Please provide the name, address, contact name, and title of three clients as references. If your firm maintains more than one office location, indicate from out of which office each client is served. Meridian Risk Management is proud to work with the following organizations of a similar size/scope to Iroquois. All references are serviced out of the Fairfield, CT and Pelham, NY offices. 1. Client Name – United Services, Inc. – Dayville, CT Size – 250 total employees – 65 non-union (management) employees Length of Relationship – 2013 – Current Contact Person / Title – Cassie Mantoni – Director of Human Resources or Rob Deverna CFO Phone / Email – 860-774-2020 / dvcmantoni@usmhs.org or rdeverna@usmhs.org 2. Client Name – Mitchell Martin, Inc. – New York, NY (7 Additional States) Size – 600 employees Length of Relationship – 2018 – Current Contact Person / Title – Dawn Ponico – Vice President of Human Resources Phone / Email – 646-300-7016 / dponico@itmmi.com 3. Client Name – Aquinas Consulting – Milford, CT Size – 90 employees Length of Relationship – 2020 – Current Contact Person / Title – Sally Reed – Director of Human Resources Phone / Email – 203-876-2822 / sreed@aquinasconsulting.com 4. Client Name – Seymour Sheridan, Inc. – Monroe, CT Size – 65 employees Length of Relationship – 2011 – Current Contact Person / Title – Janet Viel – Director of Finance Phone / Email – 203-261-4009 / jviel@seymoursheridan.com 12

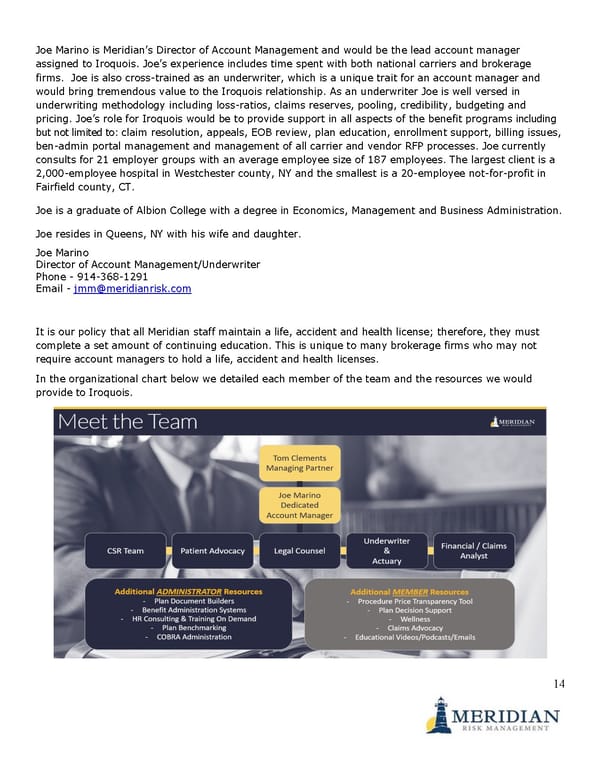

Staff/Team D. Staff/Team 1. Identify the different classification of employees within the firm and the totals for each classification (i.e., consultants, compliance professionals, administrative support, insurance advocates, etc.) Please provide an organizational chart showing functions and locations of benefit advisors/account executives. 2. List the name and location of primary individual(s) who would be responsible for our account and provide brief biographies including titles, functions, academic credentials, and relevant experience. 3. Please indicate the turnover of senior management and key professionals within your firm over the past three years. 4. How is your benefits advisors/account executive’s compensation determined? 5. Will your firm, its employees and/or affiliated or related entity be paid fees/derive an economic benefit for its services? Meridian offers a unique approach to client management by leveraging best in class experts and technical resources with hands on service. It is our practice that a Partner of Meridian represents our clients from both a strategic and day-to-day service perspective. Taking this approach ensures that ultimate accountability rests with a member of Meridian senior management which has had zero turnover in the past 3 years. In addition, we have built a team of seasoned benefit professionals and vendors that consist of dedicated senior level account managers, ERISA attorneys, HR consultants, underwriters, marketing and communication consultants. The lead consultant for Iroquois is Tom Clements who is in our Fairfield, CT office. Tom is the Managing Partner of the employee benefits division at Meridian and specializes in all aspects of health and welfare benefit plans. Tom is an expert in the employee benefits space and is a regular speaker at conventions along with conducting employee trainings on a variety of topics including, alternate funding medical plans (level-funded, Captive, PEO etc.), compliance (ACA, ERISA), effective communication strategies, leveraging technology trends in employee benefits (telemedicine, App based cost containment tools etc.) and plan specific benchmarking. Tom would act as a consultant throughout the course of the year regarding all aspects of the Iroquois account including but not limited to; renewal negotiations, open enrollment, employee communications, cost containment, strategic planning, compliance, plan benchmarking, HR support and wellness. Tom has a proven track record for analyzing and aligning solutions to fit his client’s goals and objectives. Tom currently consults for 35 employer groups with an average employee size of 134 employees. The largest client is a 2,000-employee hospital in Westchester county, NY and the smallest is a 7 employee quasi-municipal entity in upstate Connecticut. Tom is a graduate of Fairfield University with a degree in Finance and Marketing. Tom resides in Fairfield with his wife and two children. Tom Clements Managing Partner – Employee Benefits Phone - 203-339-2735 Email - tc@meridianrisk.com 13

Joe Marino is Meridian’s Director of Account Management and would be the lead account manager assigned to Iroquois. Joe’s experience includes time spent with both national carriers and brokerage firms. Joe is also cross-trained as an underwriter, which is a unique trait for an account manager and would bring tremendous value to the Iroquois relationship. As an underwriter Joe is well versed in underwriting methodology including loss-ratios, claims reserves, pooling, credibility, budgeting and pricing. Joe’s role for Iroquois would be to provide support in all aspects of the benefit programs including but not limited to: claim resolution, appeals, EOB review, plan education, enrollment support, billing issues, ben-admin portal management and management of all carrier and vendor RFP processes. Joe currently consults for 21 employer groups with an average employee size of 187 employees. The largest client is a 2,000-employee hospital in Westchester county, NY and the smallest is a 20-employee not-for-profit in Fairfield county, CT. Joe is a graduate of Albion College with a degree in Economics, Management and Business Administration. Joe resides in Queens, NY with his wife and daughter. Joe Marino Director of Account Management/Underwriter Phone - 914-368-1291 Email - jmm@meridianrisk.com It is our policy that all Meridian staff maintain a life, accident and health license; therefore, they must complete a set amount of continuing education. This is unique to many brokerage firms who may not require account managers to hold a life, accident and health licenses. In the organizational chart below we detailed each member of the team and the resources we would provide to Iroquois. 14

In addition to the personnel responsible for the Iroquois account, Meridian runs a Customer Relationship Management tool that is built specifically for health and welfare brokers. Each interaction we have with Iroquois staff or members is tracked by our system, so in the event the assigned personnel are unavailable, any authorized staff member can locate and review the Iroquois account and work on any open tasks. The system includes task management and tracking functions, which will allow all Meridian team members to designate responsibilities for tasks and set timeframes for completion. This ensures that team members are accountable for specific tasks and sets expectations for completion. Our compensation structure is unique to the industry in that our consultants/advisors are paid on a salary basis and not 100% contingent upon revenue generation. This ensures unbiased recommendations, no conflicts of interest or misaligned incentives. For example, if a consultant is paid on a commission basis and the client receives an increase, then that means the consultant receives a pay rise. We do not believe in unjustified rewards, so our consultants are paid a salary that is reviewed periodically. As a firm, we are compensated in one of three ways; commission based payable from the insurance carriers, fee-based payable by the client or a hybrid of the two. We are 100% transparent, and only accept the carrier standard commissions when compensation is structured in that model. In addition, we do not accept any contingent bonuses or overrides. We detail our firm compensation structure in more detail, in the appropriate ‘Fees’ section. In short, we have no doubt that our experienced team coupled with our proprietary tools and resources would be an invaluable asset to the Iroquois’s employee benefit programs over the short and long-term. Scope of Services E. Scope of Services 1. Understanding the Scope of Services, please describe the following: i. Information that explains the firm’s ability to perform, implement and administer these services, emphasizing experience with other similarly sized companies. How many benefit plans do you administer for companies our size? How many new clients per year? ii. Describe your firms’ general approach, philosophy, capabilities and experience in providing advisory and advocacy services to establish goals, guidelines and objectives and the establishment and/or review of benefit options; and iii. Describe the benefit analysis approach that will be used to service the benefit plans, including explanation of methodologies employed. How often do you provide benefit plan performance reviews? iv. Describe the firms’ capabilities in providing benefit fee benchmarking analysis. v. Describe the standard reporting package Human Resources would receive. How often are such reports produced? Are reports available on request? vi. What can you offer us in the way of ease of administrations? Based upon the provided scope of services we have broken up our responses based upon certain areas including; RFP’s, vendor/program management, renewal process, open enrollment, plan benchmarking, communications, wellness and client retention/examples. 15

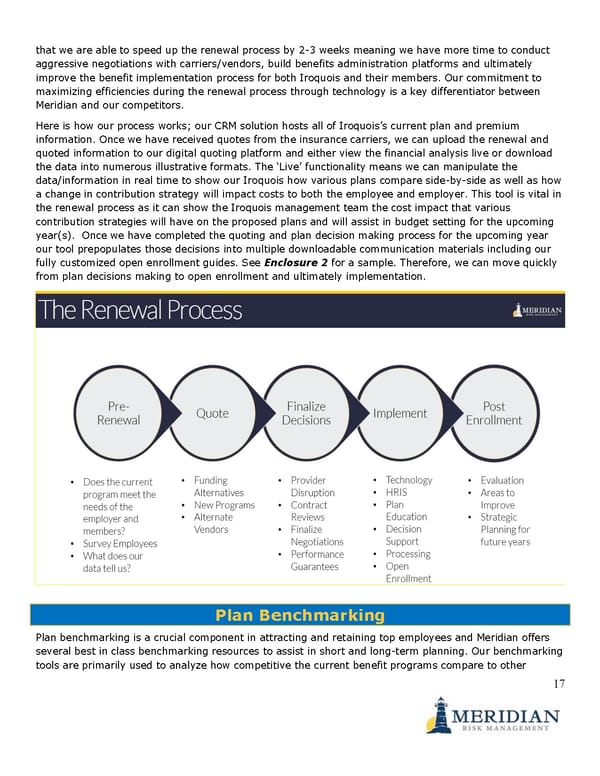

Request for Proposal & Plan/Vendor Management Meridian specializes in all facets of health and welfare consulting, including; medical, dental, vision, life, AD&D, disability, voluntary benefits, FSA/HRA/HSA and is very well versed in the RFP process. During our pre-renewal meeting (usually in September) Meridian will gain a clear understanding of Iroquois’s goals of the benefit programs and develop a customized RFP based upon those needs. Our goal is to handle the heavy lifting and make sure the process runs as efficiently as possible. The first step in the RFP process, is for Meridian to access demographic information of Iroquois members in the form of a census. Typically, we will either request a membership listing from the incumbent carrier(s), use a census report from the clients HRIS system or work off a census template that we provide to Iroquois. During the census data collection process, we will develop a draft RFP including the bid specifications outlined in our pre-renewal meeting along with who we plan to solicit proposals from in the insurance market place. Once complete we send the draft RFP to Iroquois for approval and then release to the market. Many of the medical markets have access to alternative funding methods such as, level-funded, captive insurance or self-funded, so if applicable we would submit the RFP to encompass those funding alternatives. Similarly, for the dental coverage, we will go to the carriers with the strongest networks and deepest discounts. For all other ancillary and voluntary products, we would request proposals from carriers that we have experienced as being competitive in the industry or employer size. Once we receive quotes from the appropriate carriers, we follow the Meridian renewal process and provide a full financial comparison to Iroquois. Tom Clements would personally meet with the Iroquois management team to review the alternatives, make recommendations on carriers/plan designs, network strength, customer service, contract provisions and financial stability. During the analysis we request that the appropriate carriers/vendors provide us with a performance guarantee for the year. In the past, performance guarantees have allowed us to decrease client financial liabilities including premiums, administrative or service costs, in the event the carrier/vendor does not meet the guarantee. Meridian continuously monitors and evaluates the carrier/vendor performance and assists in preventing and resolving service issues over the course of the contract. Once we have narrowed the scope to a few plan designs or carriers, if applicable, we conduct a finalist presentation. The finalist presentation allows Iroquois and Meridian to determine whether there is an appropriate fit between the carrier and Iroquois. At the conclusion of negotiations, we have the appropriate carrier(s) finalize their contract offers and make sure that the proposed contract is accurate and consistent with the quoted option(s). Once we have completed the analysis and finalized the negotiations, we inform Iroquois that we are ready to move forward with the implementation phase of the renewal process. In the event Iroquois would like to “rebid” any portion of the RFP, Meridian will follow the outlined process and make any necessary bid changes that the Iroquois requests. Renewal Process Meridian has a unique approach to the renewal process that is seamless and operationally efficient. Unlike many of our peers our approach is fully automated and online. By utilizing this process, we have found 16

that we are able to speed up the renewal process by 2-3 weeks meaning we have more time to conduct aggressive negotiations with carriers/vendors, build benefits administration platforms and ultimately improve the benefit implementation process for both Iroquois and their members. Our commitment to maximizing efficiencies during the renewal process through technology is a key differentiator between Meridian and our competitors. Here is how our process works; our CRM solution hosts all of Iroquois’s current plan and premium information. Once we have received quotes from the insurance carriers, we can upload the renewal and quoted information to our digital quoting platform and either view the financial analysis live or download the data into numerous illustrative formats. The ‘Live’ functionality means we can manipulate the data/information in real time to show our Iroquois how various plans compare side-by-side as well as how a change in contribution strategy will impact costs to both the employee and employer. This tool is vital in the renewal process as it can show the Iroquois management team the cost impact that various contribution strategies will have on the proposed plans and will assist in budget setting for the upcoming year(s). Once we have completed the quoting and plan decision making process for the upcoming year our tool prepopulates those decisions into multiple downloadable communication materials including our fully customized open enrollment guides. See Enclosure 2 for a sample. Therefore, we can move quickly from plan decisions making to open enrollment and ultimately implementation. Plan Benchmarking Plan benchmarking is a crucial component in attracting and retaining top employees and Meridian offers several best in class benchmarking resources to assist in short and long-term planning. Our benchmarking tools are primarily used to analyze how competitive the current benefit programs compare to other 17

employers on a national, regional, industry and employer size basis. We typically use the benchmarking data when analyzing alternative plan designs, contribution strategies, new program adoption and cost containment. As part of UBA, we have access to the largest national employee benefit survey data set. The UBA survey garners 15,000+ responses annually and is so highly regarded that in 2018 it was passed out to all members of congress, so they could analyze and interpret what benefits companies are offering their employees and how much they cost. Through several vendors partners we have access to additional benchmarking studies including information on salary, PTO benefits, absence management and employee engagement. In short, our benchmarking resources are best in class and allow us to position Iroquois as competitively as possible within the marketplace, while also meeting the goals and budget of the organization. Open Enrollment The Meridian open enrollment process is multifaceted from both an employer and employee standpoint and runs the gamut of data collection and implementation to employee and dependent communication. The key to a successful open enrollment is strategy and execution. We work with Iroquois during our pre-renewal meeting to develop a strategy and timeline to conduct open enrollment that is tracked and managed in our CRM. Meridian has the capabilities to conduct an all manual open enrollment period with in-person meetings a paper-based enrollment forms all the way to a fully digital open enrollment with online meetings and benefit enrollment portals. Should Iroquois wish to utilize an online open enrollment solution, Meridian commits to assist Iroquois in the analysis of various benefit administration platforms, such as, Employee Navigator, Ease, PlanSource, B-Swift, or Maxwell to name but a few. If Iroquois would like to move forward with a new system Meridian will lead the implementation from start to finish. If granted access to a current system Meridian will work with the current vendor to update the enrollment site with any new information and provide ongoing management. Our employee/member communication strategy is multi-layered; firstly, Meridian is always readily available to conduct open enrollment meetings with Iroquois employees’ onsite. Secondly, we supplement the in-person meetings with open enrollment webinars that can be conducted during and after business hours for both employees, spouses and dependents. Finally, Meridian provides members with access to an open-enrollment digital member experience (MX) presentation(s). The MX presentation(s) are designed to ensure that employees, spouses and dependents receive clear and consistent information regarding their benefit options, cost savings tips and how to enroll. The presentation is fully interactive and can link out to carrier websites, HRIS/Ben-Admin enrollment platforms and also incorporates ‘calls-to-action’. An example of a CTA would be carrier videos on wellness offerings, downloadable benefit summaries etc. In addition, viewing of the MX presentations are trackable, therefore we can review what information members were interested in and use it to boost engagement metrics in the future. Click To View an MX Example Our digital technology solutions called TouchPoints and our mobile app PocketPal allow members access 18

to benefits information 24/7, which has in the past limited questions both Meridian and the Iroquois HR department receives both during open enrollment and throughout the course of the year. Our solutions are fully customizable for new hire orientation, communication campaigns on items, such as, telemedicine or wellness, etc. We can push information to employees via app alerts, robo calls, SMS, and email. We can track viewer data, so that we can refine our process to boost engagement metrics. During the open enrollment process, all Iroquois employees receive a customized open-enrollment guide which includes a high-level overview of the Iroquois plans, cost savings programs, payroll deductions, and all the necessary Federal and State model notices to satisfy the annual requirements. Enclosure 3. All employees will also receive the necessary carrier information from plan summaries, summary of benefits and coverage, carrier specific programs, etc. In addition, Meridian deploys our digital benefits counselor ‘Alex’. Alex is used by numerous Fortune 500 companies in support of open enrollment and is a fully customizable, online, plan decision support tool, that factors in an individual’s demographics, expected utilization, premium contributions and tax implications. The goal of Alex is to guide employees to the most cost-efficient plan options offered, all with a twist of humor added in. When utilizing the Alex tool, Meridian has an average medical plan migration rate of 11% from the highest cost plan to the lowest cost plan, so it will help in Iroquois’s cost containment efforts. In addition, Alex removes Meridian and the Iroquois Human Resources team from having to answer questions from employees that can only be answered correctly by asking employees personal health questions, which is a violation of HIPAA laws. Below are some videos that introduce you to ‘Alex’. Meet ALEX / ALEX Benefits Sneak Peek Once open enrollment is complete Meridian processes all of the necessary data with the carriers either through an online portal or manual enrollment forms to ensure a smooth transition to the new plan year/carrier. If any issues arise Meridian is always available to Iroquois to address any concerns quickly and efficiently including issuing temporary ID cards, calling provider offices to verify coverage etc. In short, we have vast experience conducting all manner of open enrollment strategies in both a manual, online or hybrid fashion, so Iroquois and their members can rest assured that Meridian has the tools and capabilities to ensure a seamless open enrollment experience. Communication Communication from both an employee and employer level are a key component of our client relationships. At regular intervals Meridian discusses with Iroquois an internal and external communication strategy that is tracked and managed in our CRM. The strategy includes how and when various the types of communication campaigns will be launched, such as, total compensation statements, cost-efficient plan usage, wellness, know your benefits campaigns, and other ad-hoc communications. 19

Meridian has multiple resources to design, edit, produce, print and distribute custom communications via email, video, web and paper, so we can make sure to reach Iroquois employees and members across an array of verticals. Below is a sampling of communication campaigns we have launched: ¨ Monthly “Live Well Work Well” newsletter – an employee focused health & wellness publication ¨ Telemedicine – how, why and when to use your telemedicine feature ¨ Rx Coupon Sourcing – how to search for lower cost Rx drug alternatives ¨ Introduction to Benefits – terms and definitions, explanation of benefits review, life cycle of a claim ¨ Know your Benefits –help employees understand how their programs work and how to be good consumers ¨ Carrier Resources – gym reimbursement, wellness tools, rewards programs, disease management ¨ Preventive Care – what is preventative care, what is covered, etc. ¨ Rx management – reduce your costs, generic versus brand, etc. ¨ Consumerism Strategies – stretching your health care dollars, being a wise consumer ¨ Employee Surveys - identify educational issues and preferred method of communication ¨ Wellness Campaign – focusing on target areas of importance – weight loss, smoking cessation ¨ Plan/Program Education; Emergency Room versus Urgent Care, Brand Names versus Generic Rx, Preventative Care, Voluntary Benefits In short, Meridian will build customized communication campaigns based on Iroquois’s wants and needs that can be delivered across a range of mediums. Wellness Meridian will assist Iroquois in developing and managing workplace wellness initiatives that reduce health care costs and increase employee productivity and satisfaction. Through a variety of tools and resources we can build a customized wellness strategy that is specific to the areas of importance to Iroquois and their employees. We can launch/relaunch wellness campaigns across a plethora of mediums including email blasts, posters, paper-based newsletters, videos, digital presentations and in-person that are designed to help Iroquois drive consumerism in the workplace. Meridian has strategic relationships with a variety of local health care professionals/vendors to assist in employee health fairs. Our partners can help Iroquois employees identify their unique, personal risk factors and how to mitigate potential current/future health conditions. Below are some of the areas that Meridian can assist with your current wellness programs and/or add new resources for wellness. ¨ Wellness Assessment ¨ How employees currently access wellness offerings and identify areas that are achieving goals and those that can be improved 20

¨ Review and analyze prior wellness activities ¨ Coordinate vendor participation ¨ Data Analysis - review historical data, claims reports (if applicable), employee survey results to develop a wellness action plan targeting specific areas ¨ How does social media fit in to wellness? ¨ Review the wellness program – was it a success? Refine and re-launch if applicable ¨ Thousands of wellness related materials ¨ Consulting for on-site clinics and best practices In short, Meridian will take the lead in implementing and managing Iroquois’s wellness programs based on the goals set forth by the organization. Client Retention/Experience Client Retention Tom Clements’ client retention rate has been 98% for the past several years. The only clients that have ever left were due to M&A with larger entities, where those clients were not the controlling entity, due to incoming C-suite relationships or for a program that does not work with brokerage firms. Experience & Renewal Negotiations Meridian currently represents 20+ groups in the 25-99 health insurance market space in CT/NY. The small-medium sized business marketplace is one that Meridian has a significant amount of experience in servicing and negotiating renewals. We have longstanding relationships with the carriers and carrier representatives in this market space which allows us to more aggressively negotiate our client’s renewals. In addition, we average 20+ new clients annually out of our Fairfield & Pelham offices. Below are some examples of recent renewals in this space along with some innovative strategies we have initiated. Example 1 65 employee manufacturing firm – the most recent May 1, 2021 renewal started with a 18% requested increase from the carrier. Through a competitive RFP process, and negotiations, the group received a flat 0% renewal with no carrier or plan design changes. Over the course of the past 5 renewals the group has maintained the same carrier, same plan designs and have had a net increase over those 5 years of 8%. That is an average of 1.6% annually, compared to trend which is 8-12% annually. Example 2 75 employee manufacturing firm – most recent May 1, 2021 the carrier was requesting a 23% increase. Through a competitive RFP process, and negotiation, the group switched to a larger insurance carrier for a 7% increase and richer benefit plans (significantly lower out of pocket maximum and better Rx copays after the deductible). We also decreased their dental premiums by -15% and had a cumulative decrease of -10+% on their life and disability programs. Example 3 – Innovative Strategic Solution – Level-Funding 40 employee quasi-municipal entity in a level-funded plan – the most recent renewal 10/1/2020 the carrier requested a 14% increase. Through a no bid RFP process, as well as leveraging our actuarial software, the group received a flat renewal. Over the course of our 8-year relationship the group has 21

received a net increase of 23% which is an average of 3% annually. The group has maintained the same carrier and same union negotiated benefits for 7 of the 8-years. In addition, as part of the level-funded agreement where the group shares in any surplus, they have received administrative credits in 5 of the 8 years totaling $175,000+. This past year’s surplus ($70,000) equated to a 12% premium equivalent, so they have performed far superior to their 23% net increase over 8 years when surplus amounts are factored in. In 2013, we took the dental program self-funded and in the first year saved $35,000 in total cost. The dental program has significantly outperformed the fully insured equivalent rate for the last 7 years saving the group thousands of dollars annually. Example 4 – Innovative Strategic Solution – PEO Solution 100 employee hardware store chain with 17 locations. We consulted with the group 3 months prior to their 11/1/19 renewal where they were receiving a 9% increase to their benefit costs. We submitted the group to one of our preferred PEO partners who offered a -30% decrease under the benefit renewal cost (21% under current costs). This allowed the group to reconfigure their plans and contributions for the better, and still manage to obtain a -5% renewal under current costs. In addition, prior to the PEO taking over, the group needed to recruit a new controller and with our assistance and that of the PEO’s recruiting department we were able to provide two controller candidates. They were so happy with the candidates, that they ended up hiring both. Example 5 – Innovative Strategic Solution – Rx Carve Out 900 employee not-for-profit organization. While this employer is significantly larger than Iroquois, as you continue to grow and self-funding your medical program perhaps becomes a reality you may consider an Rx carve out program. An Rx carve out program is when a group partners directly with a pharmacy benefit manager, instead of through the carrier. In this example the client was working with two national brokerage firms who failed to advise them to explore this option. Therefore, they accepted our offer to review their Rx programs through OptumRx. Through our analysis we discovered that if they partnered directly with OptumRx instead of through their carrier they could obtain more favorable contract provisions; lower dispensing fees, lower ingredient costs, greater rebate shares etc. The guaranteed minimum savings over a 3-year period was 2.4million with no change to the PBM (they still use OptumRx), the plan designs or the drug formulary. All the savings were driven solely by renegotiating the terms and provisions of the pharmacy contract. We believe that these ‘think outside the box’ strategies are what differentiates our firm from other brokerage agencies as we have extensive experience with a wide variety of cost containment programs, vendors and products. Performance Monitoring F. Performance Monitoring 1. Describe how the firm evaluates/monitors a benefit provider’s performance. 2. Describe how the firm monitors claims and offers suggestions for plan designs to meet the needs of participants. 22

Strategic Planning & Cost Containment Our new client transition plan and client onboarding process begins upon receipt of the signed broker-of- record (BOR) letters for the clients existing lines of coverage. During this time, we develop our customized new client checklist inside of our CRM system, so that we can assign and track the onboarding process through completion. When processing the BOR with the current insurance carriers we request all contracts, benefit summaries, current invoices, membership reports and key contacts for review and upload to our CRM, so that we can immediately begin servicing the clients account, their members and reviewing the benefits services for technical accuracy. Our next step would be an introductory meeting or call between the key stakeholders at Iroquois and the consulting/service team at Meridian to answer any questions and build out action items that are of importance. The action items include executing business associate agreements, setting up carrier/vendor web access, setting up Meridian services (ThinkHR etc.), reviewing summary plan descriptions and discussing any areas of concern we have identified within the in-force plans. If any areas of concern exist, we will work with the carrier/vendor and Iroquois to resolve the issue(s) in a quick and efficient manner while assisting in writing any plan modification documents that may be required. As the Iroquois renewal is 1/1, we would typically schedule a pre-renewal meeting at the beginning of September, so we can gain an understanding of the organization’s goals, as well as, establish a renewal timeline. During the pre-renewal meeting we would discuss the RFP process, plan designs under consideration, any new programs Iroquois may like to implement, open enrollment communication strategy with target dates and whether you are/will be using a benefits administration platform to assist with open enrollment. Based on feedback from the pre-renewal meeting we will set-up a renewal strategy and timeline for vendor analysis, plan decision making and implementation that will be tracked through completion in our CRM. For clarity, please keep in mind that extremely limited claims data is available for fully insured groups with 51-99 employees written out of the state of Connecticut and New York. If claims data were to ever be made available, prior to formulating our RFP for the carriers, Meridian would run the Iroquois medical program through our actuarial software. The actuarial software will make sure your current/renewal rates are in line with the data shown in our actuarial system, as well as to see whether self-funding is feasible. If our actuarial data differs from the carrier provided renewal data, we use that as a key negotiating tactic. Generally, our actuarial analysis can be completed within 24-48 hours, so we are capable of a very quick turnaround. Our actuarial software database is made up of over 100 billion dollars’ worth of claims data, so is a larger data set than many insurance companies. The software has three (3) primary features; Actuarial Assistant, Risk Decision and Experience Migration. The Actuarial Assistant module allows Meridian to compare, evaluate, analyze and customize plan options. When using the Actuarial Assistant, we could show Iroquois how a change in plan design, provider networks, demographics and/or risk levels impacts overall cost. We also utilize the Actuarial Assistant to predict a client’s renewal cost, leverage the data to negotiate with the carrier and set appropriate claims reserves, if they are self-funded. 23

The Experience/Migration Predictive Analytics module can forecast employee migration from one plan to another, creates budget/funding rates and demonstrates scenarios where a change of plan may cost more than expected. The Risk Decision module shows how likely a group would be to ‘win’ by self-funding or level-funding their medical plan. The tool shows how changes in plan mechanics, such as, pooling levels and credibility impacts cost along with how much self-funded administration and stop-loss insurance would cost. Like most employers, we know Iroquois’s major challenges are the rising cost of healthcare and the increased regulatory factors centered around all employee benefits plans. The key to cost containment is trying to understand cost drivers that impact cost, educating members to prevent claims leakage in the program(s) and leveraging technology enhancements to not only lower costs but provide a higher quality of care. In a scenario where claims data is available, the lead consultant and underwriter would assist Iroquois in the analysis and interpretation of the claims data. Through the carrier provided data we could identify areas of concern and consumerism trends and develop a cost mitigation plan to address them on a monthly, quarterly or as needed basis. The cost mitigation plan may encompass such items as, plan design changes or member education. Our financial reports are customizable and would be specific to Iroquois’s needs, but would generally include information on gross claims, net claims, loss ratios, claimants that breached specific percentages/dollar amounts of the pooling point thresholds, the ‘rolling’ 12 months of claims, month by month enrollment, claims vs. premiums and historical claims for previous years. We are firm believers that to manage cost, you also need to manage behavior. We understand that making conscientious decisions about consuming health care requires access to information and that given the correct education, you and your employees will make better buying decisions, ultimately reducing costs. A great way to access this information and identify potentially damaging consumerism patterns is to survey your employees which we have performed numerous times in the past. Our employee-based surveys can provide Iroquois with data on: ¨ What is important to employees? How well do they understand their benefits? What is the best way to deliver relevant information? Provide scenarios on how they access care; ER vs. UC, Generic vs. Brand. ¨ By analyzing the responses, we can implement a strategy to reduce claims cost through education and/or plan design amendments Meridian has implemented several programs based on employee survey responses and has designed customized campaigns to provide information to the consumer. Here are just a few examples and recommendations: ¨ Telemedicine – having a low cost, convenient alternative for non-life-threatening treatments is paramount. During open enrollment and throughout the year information is available on when, why and how to use the benefit correctly. There is a heightened awareness around telemedicine, given the current coronavirus pandemic, so members should be aware the programs exist and utilizing the benefit. If we can continue to steer members toward the telemedicine benefit you would see a downturn in claims leakage for non-emergent issues. Telemedicine is now also available for 24

behavioral health counseling, dental check-ups, dermatological issues etc. and we expect this benefit to continue to grow in utilization and popularity in the future. ¨ Procedure price transparency either through the carrier or app-based technology is designed to assist members in seeking lower cost alternatives for the same service. By leveraging technology, members can create good consumerism habits right in the palm of their hand. Several procedure price transparency solutions exist in the marketplace today where members can ‘shop’ for the same services and make decisions based on not only price, but quality of care. ¨ Rx rebates and coupon sourcing – There are several app-based technologies that can aggregate manufacturer rebates and coupons, so that members can access prescriptions at a lower cost. These programs run outside of insurance, so whenever a member utilizes the program the claim does not factor into Iroquois’s overall utilization which will help keep renewal premiums down. These types of programs are of an even greater benefit to the members enrolled in the HSA plan, as they must satisfy the deductible before prescriptions move to a copay. ¨ Voluntary Benefits to supplement your coverages. Offering members, a variety of programs to meet their needs helps from an attraction and retention standpoint at no additional cost to the organization. ¨ Medicare meetings to inform applicable employees of their Medicare options. By conducting these meetings, we may migrate some members off the Iroquois plan and on to Medicare. It will also educate members with Medicare eligible relatives/friends who may be tasked with sourcing Medicare supplement plans. ¨ Meridian has access to several proprietary programs through the UBA relationship. These programs include: level-funded insurance, captive plans and stop-loss coalition programs. Through these programs, Meridian/UBA have been able to save clients significant dollar amounts which include immediate premium discounts, experience-based refunds and wellness/predictive modeling reimbursements. The second part of the client onboarding process is to analyze the various compliance requirements of Iroquois and set in motion action steps to either maintain compliance or move the program(s) back into compliance. These steps include; reviewing contracts, plan documents, insurance policies and other documents such as, annual model notices, summary plan descriptions, business associate agreements, ACA compliance to ensure applicability, accuracy, consistency and ultimately compliance. All compliance requirements are tracked and assigned in our CRM with notifications sent out 90, 60- and 30-days prior to the deadlines, so they are always met. In short, our transition plans are aimed to ensure a seamless integration/onboarding with Meridian. Our strategies will address the client’s specific needs and goals. Our job is to have an impact on the benefits plans by reducing costs, educating, promoting and providing the Iroquois plan members with the best benefit plans possible. Meridian Performance Not only do we monitor the carrier and vendors performance, but we also monitor our own. Upon request, Meridian can provide Iroquois with a detailed stewardship report on our performance, compensation, observations, policy summaries and a full review of the prior year’s activities, so that Iroquois can 25

accurately evaluate our firm. We analyze our own performance through employee/client satisfaction surveys, report analysis/feedback and client meetings. We firmly believe in ongoing training, especially in todays every changing environment and conduct educational sessions at least monthly. Therefore, in addition to the statutory continuing education requirements, at least annually, all employees must go through a formal and thorough performance evaluation with the Managing Partner. This evaluation addresses industry knowledge, office procedures, use of technology and client satisfaction. Fees G. Fees 1. Please provide a detailed, all-inclusive breakdown of fees included in the proposal. 2. What are the fees for set-up? 3. Is your fee quote fixed for a period of time? If so, how long? 4. Please list any additional costs the Company will incur that you have not included in your fees. Meridian Compensation Meridian is very transparent regarding our level of compensation from our clients. We agree to disclose the amount we are compensated by the Iroquois account at any point upon request, but no less than annually. Meridian offers the choice of three (3) different methods of compensation; commission based, fee-based or hybrid. Our fees never contain any ‘set-up’ costs. Commission-based arrangement: This is the way Meridian is typically compensated by small to mid-sized groups and is the most popular and preferred arrangement for groups that are fully insured or level-funded. In a commission-based arrangement we only accept amounts that the carrier deems as their standard. These commissions are pre-built into the plans and are paid to Meridian monthly by the insurance carrier. Based on client size and carrier, sometimes the carrier cannot back out commissions, if they are state filed rates. Fee-based arrangement: under this arrangement we would remove all commissions from the programs and invoice Iroquois on a monthly or quarterly basis for services. Based upon the size of Iroquois and the scope of services our fee would be $35,000 annually and guaranteed for a minimum of 3 years. We commit to only amending our fee in the future, if the population of Iroquois changes by +/- 20% or Iroquois requires an additional value-added-service that totals $5,000 or more in cost to Meridian. Hybrid arrangement – under this arrangement we would remove the commissions from the medical program and invoice Iroquois on a monthly or quarterly basis for services. All other lines of coverage would remain in a commission-based arrangement at the carrier standard level. Based upon the size of Iroquois and the scope of services our fee would be $30,000 annually and guaranteed for a minimum of 3 years. We commit to only amending our fee in the future, if the population of Iroquois changes by +/- 20% or Iroquois requires an additional value-added-service that totals $5,000 or more in cost to Meridian. These are the value-added services that are offered with all our compensation arrangements, any additional charges are clearly highlighted. 26

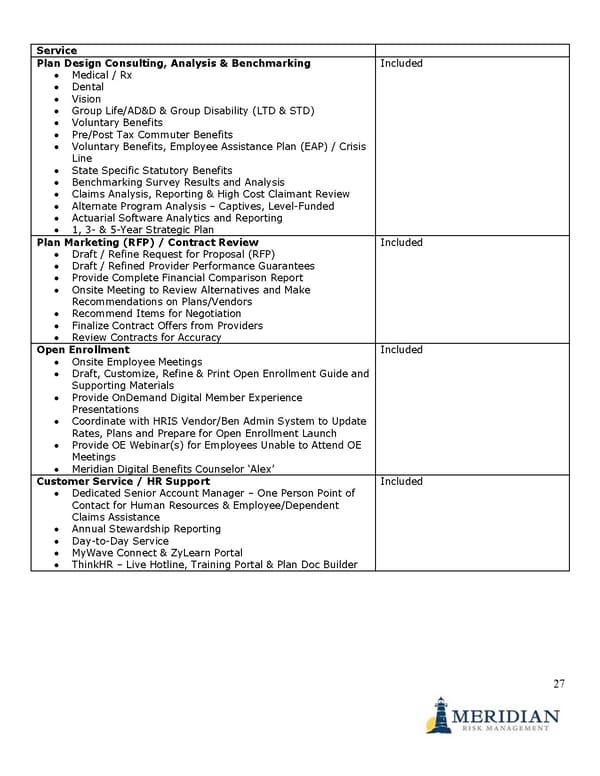

Service Plan Design Consulting, Analysis & Benchmarking Included • Medical / Rx • Dental • Vision • Group Life/AD&D & Group Disability (LTD & STD) • Voluntary Benefits • Pre/Post Tax Commuter Benefits • Voluntary Benefits, Employee Assistance Plan (EAP) / Crisis Line • State Specific Statutory Benefits • Benchmarking Survey Results and Analysis • Claims Analysis, Reporting & High Cost Claimant Review • Alternate Program Analysis – Captives, Level-Funded • Actuarial Software Analytics and Reporting • 1, 3- & 5-Year Strategic Plan Plan Marketing (RFP) / Contract Review Included • Draft / Refine Request for Proposal (RFP) • Draft / Refined Provider Performance Guarantees • Provide Complete Financial Comparison Report • Onsite Meeting to Review Alternatives and Make Recommendations on Plans/Vendors • Recommend Items for Negotiation • Finalize Contract Offers from Providers • Review Contracts for Accuracy Open Enrollment Included • Onsite Employee Meetings • Draft, Customize, Refine & Print Open Enrollment Guide and Supporting Materials • Provide OnDemand Digital Member Experience Presentations • Coordinate with HRIS Vendor/Ben Admin System to Update Rates, Plans and Prepare for Open Enrollment Launch • Provide OE Webinar(s) for Employees Unable to Attend OE Meetings • Meridian Digital Benefits Counselor ‘Alex’ Customer Service / HR Support Included • Dedicated Senior Account Manager – One Person Point of Contact for Human Resources & Employee/Dependent Claims Assistance • Annual Stewardship Reporting • Day-to-Day Service • MyWave Connect & ZyLearn Portal • ThinkHR – Live Hotline, Training Portal & Plan Doc Builder 27

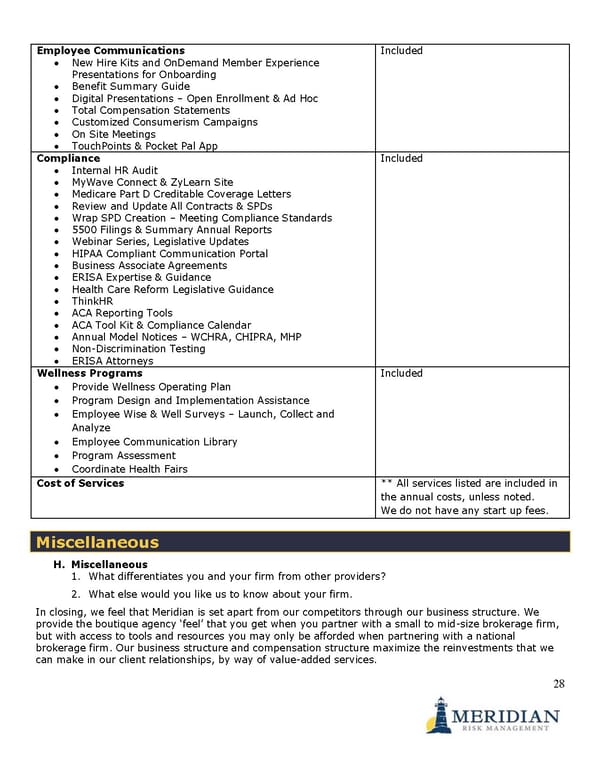

Employee Communications Included • New Hire Kits and OnDemand Member Experience Presentations for Onboarding • Benefit Summary Guide • Digital Presentations – Open Enrollment & Ad Hoc • Total Compensation Statements • Customized Consumerism Campaigns • On Site Meetings • TouchPoints & Pocket Pal App Compliance Included • Internal HR Audit • MyWave Connect & ZyLearn Site • Medicare Part D Creditable Coverage Letters • Review and Update All Contracts & SPDs • Wrap SPD Creation – Meeting Compliance Standards • 5500 Filings & Summary Annual Reports • Webinar Series, Legislative Updates • HIPAA Compliant Communication Portal • Business Associate Agreements • ERISA Expertise & Guidance • Health Care Reform Legislative Guidance • ThinkHR • ACA Reporting Tools • ACA Tool Kit & Compliance Calendar • Annual Model Notices – WCHRA, CHIPRA, MHP • Non-Discrimination Testing • ERISA Attorneys Wellness Programs Included • Provide Wellness Operating Plan • Program Design and Implementation Assistance • Employee Wise & Well Surveys – Launch, Collect and Analyze • Employee Communication Library • Program Assessment • Coordinate Health Fairs Cost of Services ** All services listed are included in the annual costs, unless noted. We do not have any start up fees. Miscellaneous H. Miscellaneous 1. What differentiates you and your firm from other providers? 2. What else would you like us to know about your firm. In closing, we feel that Meridian is set apart from our competitors through our business structure. We provide the boutique agency ‘feel’ that you get when you partner with a small to mid-size brokerage firm, but with access to tools and resources you may only be afforded when partnering with a national brokerage firm. Our business structure and compensation structure maximize the reinvestments that we can make in our client relationships, by way of value-added services. 28

In addition, Tom is an owner of Meridian, so you would be dealing directly with upper management personnel that can make on the spot decisions regarding investments and who is ultimately accountable for the organization and staff assigned to our clients. Enclosures 1. Business Associate Agreement 2. Sample Open Enrollment Guide 29